25+ Custom Manufacturing Software Statistics Showcasing Efficiency Gains and Cost Reductions

Key Custom Manufacturing Software StatisticsManufacturing ...

Author:

Ana Lozančić

If you have an iPhone, a Gmail account, or use any business software, you are using cloud-based technologies. Whether it’s storing pictures of your pet or keeping track of sales leads at work, there are obvious advantages of cloud-based software and services.

With such technologies becoming more accessible, a study in 2023 showed that 94%of companies worldwide use cloud computing in some way.

To make sure that your cloud creates value instead of cost, more and more attention falls to financial monitoring and cost management.

Cloud financial management or CFM is a system of strategies that helps companies identify, measure, monitor, and optimize cloud costs.

Cloud financial management encompasses key areas such as optimizing cloud spending, budgeting, cost forecasting, performance monitoring and reporting. It provides a comprehensive approach covering all financial aspects of using cloud computing within an organization.

The goal of a CFM system is to truly optimize cost, not just cut it. The idea is to achieve the best outcome for the lowest cost.

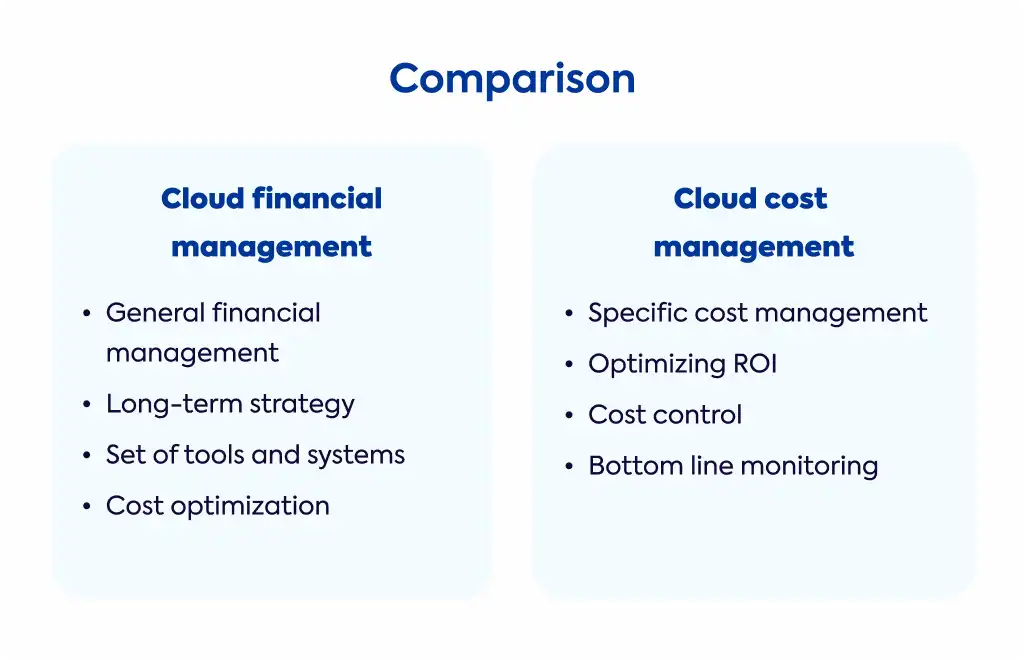

While the two terms might sound the same and are sometimes used interchangeably, they are not the same.

Cloud cost management is a subset of cloud financial management that focuses on optimizing the return on investment (ROI) and controlling the total cost of ownership (TCO) of various cloud infrastructure and services.

Simply put, cost management focuses on the bottom line, making sure that expenses are balanced with returns.

Now that we have described the differences between the two, there is one more similar term you might be interested in. Sometimes Cloud financial management is used to describe cloud-based financial software and financial management platforms, another subject we have covered.

Now that we know what cloud financial management is, the question is why do we need it and what are its benefits.

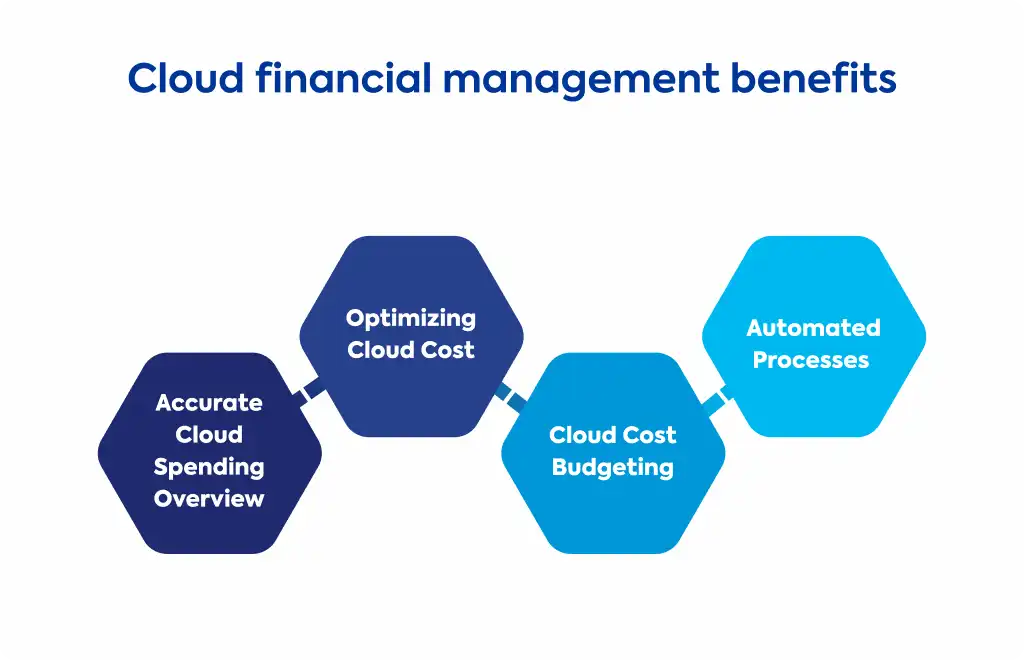

So, how can cloud financial management help organizations?

1. Accurate Cloud Spending Overview

With proper strategies in place, you are able to track not only your service usage bills, but also the operations and tasks that lead to the cost.

Analyzing the collected spending data, you can easily identify segments of your business that are driving up cloud cost. Having that information can help you optimize those processes in the long run.

With an accurate overview you can also predict future expenses and budget accordingly.

2. Optimizing Cloud Cost

Once you have an accurate insight in your spending, CMF can help you optimize cloud cost and benefits, controlling cloud-related expenses for a better return on investment.

Finding those parts of your business that are perhaps redundant, unutilized, or wasteful, provides you with cutting options without sacrificing performance.

3. Cloud Cost Budgeting

Taking in account previous usage patterns and your growth plans, you can create an accurate budget. And with a clear budget, sticking to it or adjusting it becomes that much easier.

4. Automated Processes

Plenty of cloud platforms offer tools that automate and digitize certain processes, especially the ones regarding finances.

Automatic alerts, expense tracking, usage analysis, and process breakdowns, save time while providing a solid foundation for making informed decisions.

For added precision in financial management, you can also utilize real-time cost monitoring. Being able to gather live data on usage, changes in operational costs, or any departure from the planned budget as they happen helps you react when needed.

This can be beneficial for larger companies that are at risk of runaway cost during or after the migration to cloud services.

Multiple teams and departments can participate in collaborative real-time cloud financial management. A collaborative effort will prevent making too many cuts in one area and overspending in another, allowing you to adjust your financial strategy when needed.

Once you have recognized all the benefits of cloud financial management, the question remains, how do I apply it to my business?

It is a relatively straightforward process that consists of five steps.

Step 1 – Gathering Information

Information puts the informed in informed decision making. Making accurate decisions and plans is only possible with a detailed overview of your current cloud cost and usage.

But do not only focus on the current facts, take in account your business plan and future projections.

Step 2 – Implementing Solutions

Maximizing the ROI of cloud migration with cloud financial management by implementing best practices and tools you can start balancing cost, speed, and quality.

Step 3 – Optimizing Processes

Having all the tools in place, you can improve your ROI and KPIs without compromising business goals by eliminating waste from your processes.

Step 4 – Future-proofing Plans

Setting everything in place is a good start, but as your business evolves so should your financial management practices.

Eliminating excessive cost before it happens, setting budgets based on use trends and projections, and making sure to direct resources where they are needed most.

Step 5 – Continuous Management

Setting guidelines, consolidating billing accounts for greater discounts, lowering administrative cost, and making sure everyone is on board with the set standards and regulations.

Using cloud based solutions can help you modernize and build your business, but they can get pricey.

Implementing good financial management practices will help you get all the benefits without breaking the bank.