25+ Custom Manufacturing Software Statistics Showcasing Efficiency Gains and Cost Reductions

Key Custom Manufacturing Software StatisticsManufacturing ...

Author:

Tomislav Horvat

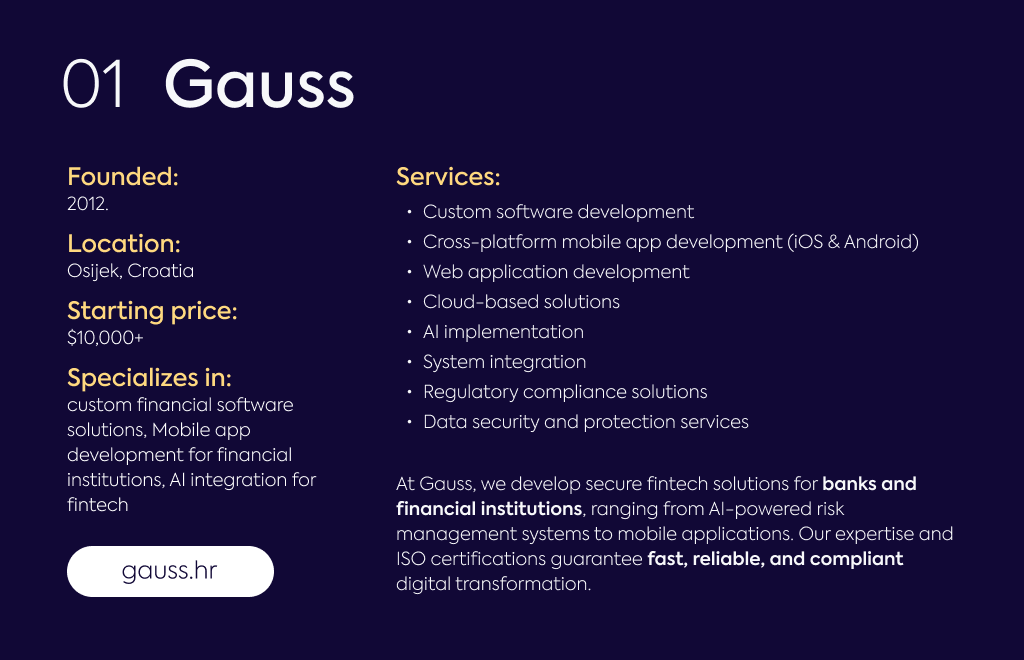

Gauss leads with proprietary Gauss Box platform and Gauss Reflect Framework for faster, more secure financial solutions, backed by ISO 9001, ISO 27001, and ISO 30301 certifications – a comprehensive technology partner since 2012

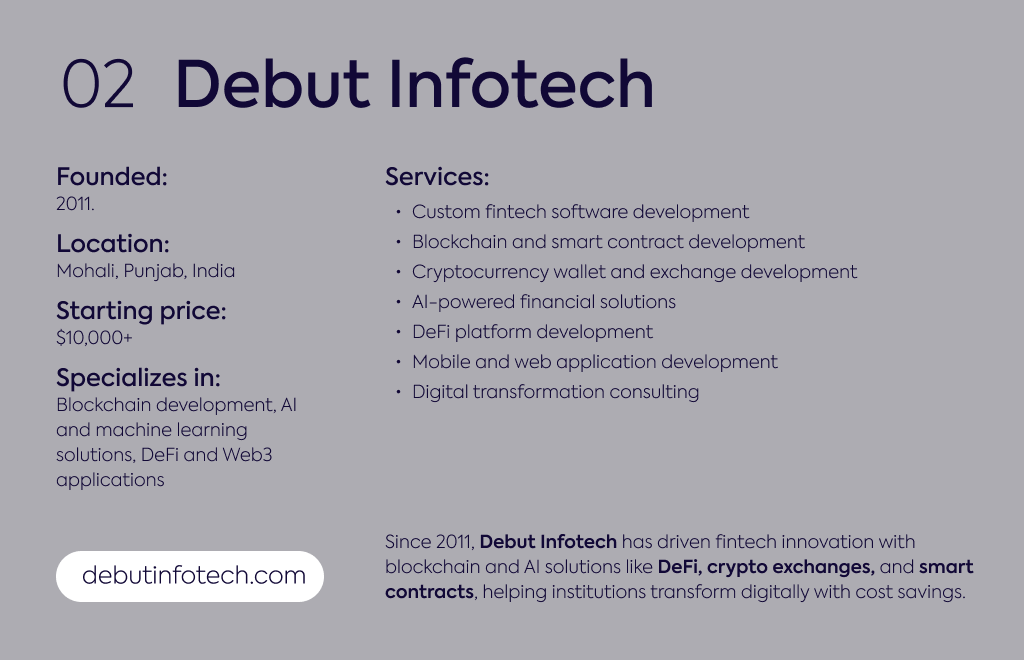

Debut Infotech specializes in blockchain and AI-powered solutions with 1,700+ projects completed and expertise in DeFi platforms and cryptocurrency exchanges

Vention brings 20+ years of fintech experience with 3,000+ engineers globally, helping clients save up to $600,000 annually through long-term partnerships

4IRE partners with major banks like Danske Bank and First Abu Dhabi Bank, offering white-label products that speed up backend development by 2x

Itexus delivers with 300+ fintech projects across 23 countries and maintains an 87% client retention rate with PhD-level engineers

Brainhub focuses on React and Node.js excellence, now expanded to 600+ experts after merging with STX Next in 2024

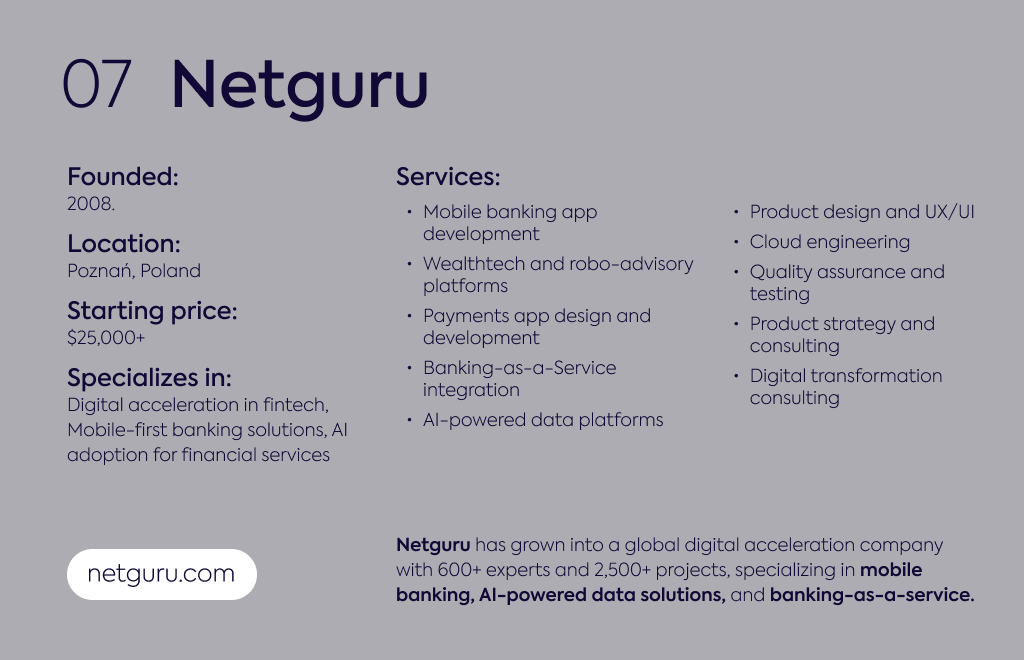

Netguru trusted by financial giants like UBS and Solarisbank, specializes in mobile-first banking experiences with 2,500+ completed projects

Hexaview Technologies ranked in Financial Times' America's Fastest Growing Companies with 90% client retention rate and strategic alliances with 150+ BFSI clients

Praxent achieves 2.94X higher project success rate than industry average with 24 years of exclusive financial services focus

Kindgeek offers ready-to-deploy white-label solutions with 72 technology platforms built over 10+ years of fintech expertise

· Founded: 2012

· Location: Osijek, Croatia

· Website: gauss.hr

· Specializes In: Custom financial software solutions, Mobile app development for financial institutions, AI integration for fintech

· Services: Custom software development, Cross-platform mobile app development (iOS and Android), Web application development, Cloud-based solutions, AI implementation, System integration, Regulatory compliance solutions, Data security and protection services

· Starting Price: $10,000+

At Gauss, we specialize in developing custom fintech software solutions that empower financial institutions to win market share and succeed.

Since our founding in 2012, we've evolved from a web development agency into a comprehensive technology partner, leveraging our proprietary Gauss Box platform and Gauss Reflect Framework to deliver secure, compliant financial solutions faster than traditional development approaches.

We work with financial agencies and banking institutions to create everything from AI-powered risk management systems to intuitive mobile banking apps, all while maintaining the highest security standards backed by our ISO 9001, ISO 27001, and ISO 30301 certifications.

Our cross-platform expertise in Flutter, combined with deep knowledge of financial regulations and real-time data processing, makes us the ideal partner for financial organizations seeking to modernize their operations, enhance customer experiences, and maintain competitive advantage through innovative technology.

· Founded: 2011

· Location: Mohali, Punjab, India (with offices in USA, UK, and Canada)

· Website: debutinfotech.com

· Specializes In: Blockchain development, AI and machine learning solutions, DeFi and Web3 applications

· Services: Custom fintech software development, Blockchain and smart contract development, Cryptocurrency wallet and exchange development, AI-powered financial solutions, DeFi platform development, Mobile and web application development, Digital transformation consulting

· Starting Price: $10,000+

Debut Infotech has established itself as a leading force in fintech innovation since 2011, specializing in cutting-edge blockchain and AI-powered financial solutions.

With over 200 industry specialists and a track record of 1,700+ successfully executed projects worldwide, they deliver sophisticated DeFi platforms, cryptocurrency exchanges, and smart contract systems that transform how financial institutions operate.

Their expertise spans from developing secure cryptocurrency wallets and NFT marketplaces to implementing advanced AI models like GPT-4 and LLaMA for intelligent financial automation.

Operating from strategic locations across India, USA, UK, and Canada, Debut Infotech combines deep Web3 knowledge with agile methodologies to help financial organizations navigate digital transformation while achieving over 60% cost savings through their efficient development approach.

· Founded: 2002

· Location: New York, New York, United States

· Website: ventionteams.com

· Specializes In: Fintech software engineering and advisory, Custom financial platform development, Compliance and regulatory integration

· Services: Custom software development, Mobile app development, Fintech consulting and strategy, Enterprise-level planning and fundraising support, Web development, QA and testing services, Modernization and migration services, Smart contract development

· Starting Price: $25,000+

For over 20 years, Vention has been at the forefront of fintech innovation, long before the sector gained mainstream recognition.

With 3,000+ engineers across 20+ global offices, they partner with everyone from early-stage startups needing MVP development to Fortune 500 companies requiring enterprise-scale solutions.

Their fintech expertise encompasses both B2B and B2C financial platforms, with deep fluency in regulatory complexities including PCI DSS, CISP, and GDPR.

What sets Vention apart is their comprehensive approach - they meet clients wherever they are in their journey, whether that means building a business case for fundraising, defining critical MVP scope, or developing cutting-edge solutions that leverage blockchain and Web 3.0 technologies.

Clients typically save up to $600,000 annually through their partnerships, with an average engagement lasting 36 months, demonstrating the lasting value they deliver to financial technology companies seeking to innovate, scale, and outpace the competition.

· Founded: 2010

· Location: Stockholm, Sweden (Swedish-Ukrainian company with offices in Canada, Sweden, Ukraine, UK, Poland, Portugal, and UAE)

· Website: 4irelabs.com

· Specializes In: Blockchain development for fintech, DeFi and banking solutions, Green Finance development

· Services: Blockchain development and consulting, Smart contract development and audit, Crypto wallet and exchange development, DeFi platform development, Mobile banking solutions, Digital wallet development, Regulatory automation, White-label fintech solutions (including ProcessMIX low-code platform), Carbon credit marketplace development

· Starting Price: $10,000+

4IRE brings over 15 years of deep fintech expertise to the blockchain revolution, partnering with major financial institutions like Danske Bank, Basis Bank, and First Abu Dhabi Bank to transform traditional banking into cutting-edge digital experiences.

As part of the 4IRE Group formed through a strategic merger with RNDPoint in 2022, they combine 300+ professionals across seven countries to deliver enterprise-grade blockchain solutions backed by European VCs.

Their unique strength lies in white-label products like ProcessMIX - a low-code platform that speeds up backend development by 2x - and their comprehensive crypto banking solutions that help financial institutions enter the digital asset space seamlessly.

With leadership that includes former executives from Mastercard, McKinsey, and Bain & Company, 4IRE bridges the gap between traditional finance and Web3, specializing in everything from DeFi protocols and smart contract audits to pioneering Green Finance platforms that tokenize carbon credits and ESG compliance systems.

· Founded: 2013

· Location: Miami Beach, Florida, United States (with development centers in Eastern Europe)

· Website: itexus.com

· Specializes In: Fintech software development, AI-powered financial analytics, Banking and payment solutions

· Services: Custom fintech software development, Mobile banking app development, Digital wallet development, AI-powered credit scoring, P2P lending platforms, Wealth management solutions, Cryptocurrency wallet development, RegTech compliance solutions, Project audit and rescue, MVP development for startups, UI/UX design

· Starting Price: $10,000+

Founded by four university friends with over 20 years of combined experience in software companies and startups, Itexus has carved out a niche as a fintech specialist with deep domain expertise.

With 300+ fintech projects delivered for 250+ clients across 23 countries, they bring PhD-level engineers and 90+ in-house specialists to tackle complex financial software challenges.

Their portfolio includes high-profile work like a PCI DSS-compliant cryptocurrency wallet ecosystem for Coinstar (a $2.2 billion revenue company) and white-label mobile banking solutions for Silicon Valley digital banking providers.

What distinguishes Itexus is their combination of technical excellence - including expertise in AI-powered financial analytics, machine learning for credit scoring, and regulatory compliance - with a startup-friendly approach that helps clients avoid common pitfalls.

They maintain an 87% client retention rate and 75% of new business comes through referrals, demonstrating their ability to deliver enterprise-grade fintech solutions while remaining flexible and cost-effective for startups needing to validate their ideas quickly.

· Founded: 2015

· Location: Gliwice, Poland

· Website: brainhub.eu

· Specializes In: React and Node.js development for fintech, Business-focused software engineering, Continuous delivery and DevOps

· Services: Custom fintech software development, Web application development, Mobile app development (React Native), Product design and UI/UX, Cloud engineering and AWS consulting, Legacy system modernization, Quality assurance and automated testing, DevOps and CI/CD implementation, Software architecture consulting

· Starting Price: $50,000+

Since 2015, Brainhub has built a reputation as a software engineering powerhouse that delivers scalable solutions for fintech clients ranging from seed-round startups to Big Four consulting firms.

With 80+ completed projects and partnerships with brands like PwC, Credit Suisse, and National Geographic, they bring deep expertise in React, Node.js, .NET, and AWS to every engagement.

Their approach is built on three unbreakable principles: continuous delivery with weekly deployments, business-oriented implementation decisions, and rigorous project governance that maintains strict oversight over budget, scope, timeline, and risks.

Following their 2024 merger with STX Next, they now offer an expanded 600+ expert team with enhanced capabilities in AI, data engineering, and machine learning.

What makes Brainhub particularly valuable for fintech companies is their focus on handling frequent and heavy data flows without compromising security, seamless integration with external services and APIs, and their ability to deliver MVPs that meet regulatory compliance while providing a strong foundation for scaling.

· Founded: 2008

· Location: Poznań, Poland

· Website: netguru.com

· Specializes In: Digital acceleration in fintech, Mobile-first banking solutions, AI adoption for financial services

· Services: Mobile banking app development, Wealthtech and robo-advisory platforms, Payments app design and development, Banking-as-a-Service integration, AI-powered data platforms, Product design and UX/UI, Cloud engineering, Quality assurance and testing, Product strategy and consulting, Digital transformation consulting

· Starting Price: $25,000+

Since 2008, Netguru has evolved from a startup in Poland's first coworking space into a global digital acceleration company trusted by financial giants like UBS, Solarisbank, and FairMoney.

With over 600 experts and 2,500+ completed projects, they specialize in building mobile-first banking experiences that combine cutting-edge technology with exceptional user experience.

Their work with UBS exemplifies their expertise - redesigning the global bank's mobile app to achieve more consistent payment flows, shorter login processes, and seamless navigation across features.

As a certified B Corporation® with an impressive NPS score of 73, Netguru brings deep fintech expertise in areas like Banking-as-a-Service integration, robo-advisory platforms, and AI-powered data solutions.

Their strategic investments in Pilot44 (working with brands like P&G and Nestlé) and mohi.to have expanded their capabilities into enterprise-level solutions, making them particularly valuable for financial institutions seeking to accelerate digital transformation while maintaining the highest standards of security, compliance, and user-centricity.

· Founded: 2010

· Location: New Delhi, India (with offices in New York and New Jersey, USA)

· Website: hexaviewtech.com

· Specializes In: Wealth management technology, Digital banking solutions, AI-powered fintech solutions

· Services: Wealth management and investment platforms, Digital lending and alternative financing, Capital market and stock market solutions, Digital banking development, AI/ML and Big Data analytics, Data visualization and business intelligence, Salesforce implementation for financial services, Cloud computing and migration, Custom fintech software development

· Starting Price: $10,000+

Hexaview Technologies has established itself as a fintech-focused digital transformation firm that has backed various startups for successful exits while serving billion-dollar enterprises.

Founded in 2010 and recognized as an Inc. 5000 company, they've built strategic alliances with over 150 clients globally in the BFSI industry.

With 300+ passionate professionals and 11+ years of fintech expertise, Hexaview specializes in leveraging cutting-edge technologies like AI, ML, Big Data, and Blockchain to deliver feature-rich financial solutions.

Their recognition includes ranking #109 in Financial Times' America's Fastest Growing Companies 2023 and #42 in 2025, demonstrating sustained growth.

As an ISO certified and Great Place to Work certified organization, they maintain a 90% client retention rate while providing comprehensive solutions spanning wealth management platforms, digital lending systems, capital market software, and digital banking applications.

Their deep domain expertise in financial services combined with technical prowess in Salesforce, cloud computing, and data science makes them particularly valuable for financial institutions seeking to modernize their operations and create innovative customer experiences.

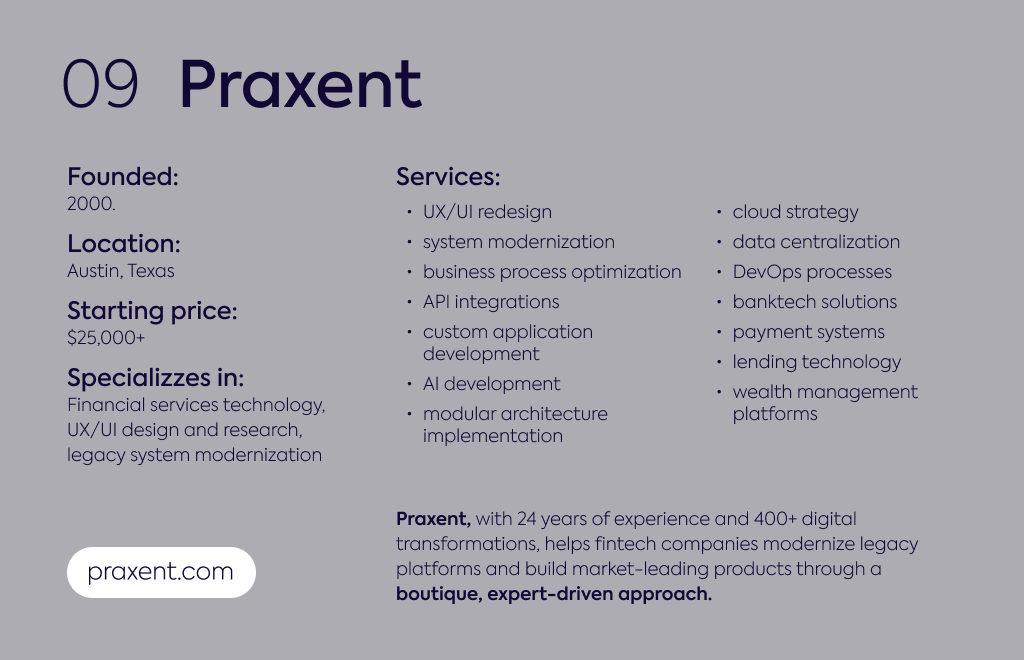

Founded: 2000

Location: Austin, Texas

Website: praxent.com

Specializes In: Financial services technology, UX/UI design and research, legacy system modernization

Services: UX/UI redesign, system modernization, business process optimization, API integrations, custom application development, AI development, modular architecture implementation, cloud strategy, data centralization, DevOps processes, banktech solutions, payment systems, lending technology, wealth management platforms

Starting Price: $25,000+

Praxent brings 24 years of focused financial services expertise to help fintechs transform outdated platforms into market-leading products.

They've completed over 400 digital transformations with a 2.94X higher project success rate than the industry average, working exclusively with financial institutions and fintechs from their Austin headquarters.

Their boutique approach means you get senior experts averaging 10.1 years of experience who integrate seamlessly with your team, not fresh graduates or outsourced talent in different time zones.

Whether you need to modernize legacy systems without losing business logic, accelerate releases through DevOps optimization, or create frictionless user experiences that actually convert prospects, Praxent delivers predictable results backed by their CAN/DO philosophy and 96% client referral rate.

· Founded: 2015

· Location: Ukraine

· Website: kindgeek.com

· Specializes In: Fintech software development, white-label banking solutions, digital transformation

· Services: Enterprise software development, web development, mobile development (iOS/Android), cloud-based software solutions, AI and ML services, digital transformation consulting, white-label neobank solutions, core payments platform development, white-label personal finance management apps, blockchain integration, chatbot development, AR/VR solutions, NFT/Web 3.0 development

· Starting Price: $50,000+

Founded in Ukraine in 2015, Kindgeek has grown into a team of 211 industry experts specializing in full-cycle fintech product engineering.

With over 10 years of fintech experience and 150+ projects delivered, they offer ready-to-deploy white-label solutions that help financial institutions launch quickly and cost-effectively.

Their 72 technology platforms demonstrate deep expertise in building secure, compliant financial products from core payments infrastructure to AI-powered banking experiences.

While maintaining operations through challenging times, they continue delivering world-class innovative services to international clients, matching technologies like blockchain, AI, and Web 3.0 with specific business needs.