25+ Custom Manufacturing Software Statistics Showcasing Efficiency Gains and Cost Reductions

Key Custom Manufacturing Software StatisticsManufacturing ...

Author:

Tomislav Horvat

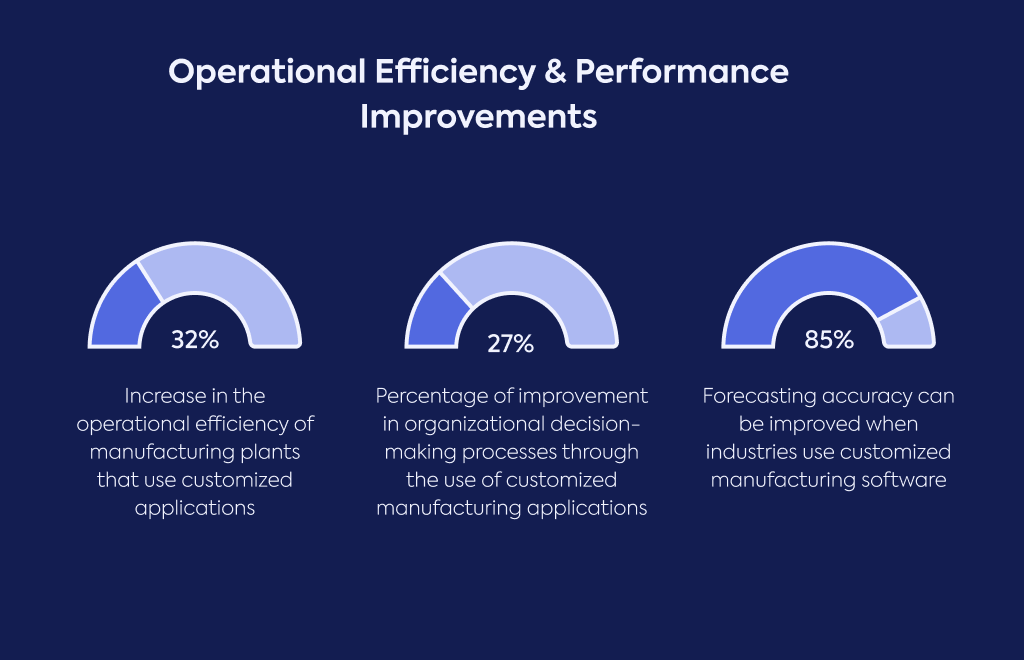

Manufacturing facilities utilizing custom apps report operational efficiency gains of 32%.

By 2023, digital transformation initiatives had been launched by 98% of 800 surveyed manufacturers spanning four global regions.

Machine downtime decreases by 30-50% across numerous industries following custom manufacturing software implementation.

Product defect rates fell by 23% for companies that deployed bespoke manufacturing applications.

By 2033, the global manufacturing operations management software market will expand to USD 76.71 billion.

Labor productivity sees gains of 15-30% when industries deploy custom manufacturing software solutions.

Manufacturing facilities utilizing custom apps report operational efficiency gains of 32%.

Throughput improvements ranging from 10-30% occur when industries adopt custom manufacturing software.

Machine downtime decreases by 30-50% across numerous industries following custom manufacturing software implementation.

Product defect rates fell by 23% for companies that deployed bespoke manufacturing applications.

Azure-powered predictive maintenance helped Tikkurila cut equipment downtime by 20%.

Tailored manufacturing applications enabled organizations to enhance their decision-making processes by 27%.

By integrating 26 data sources into a unified Power BI platform, Hochland accelerated decision-making speed by 200%.

Forecasting accuracy can improve by as much as 85% when industries utilize custom manufacturing software.

Digital order management systems slash order entry duration from 30 minutes down to just 5 minutes.

Production scheduling duration drops from 4 hours to merely 1 hour using digital order management systems.

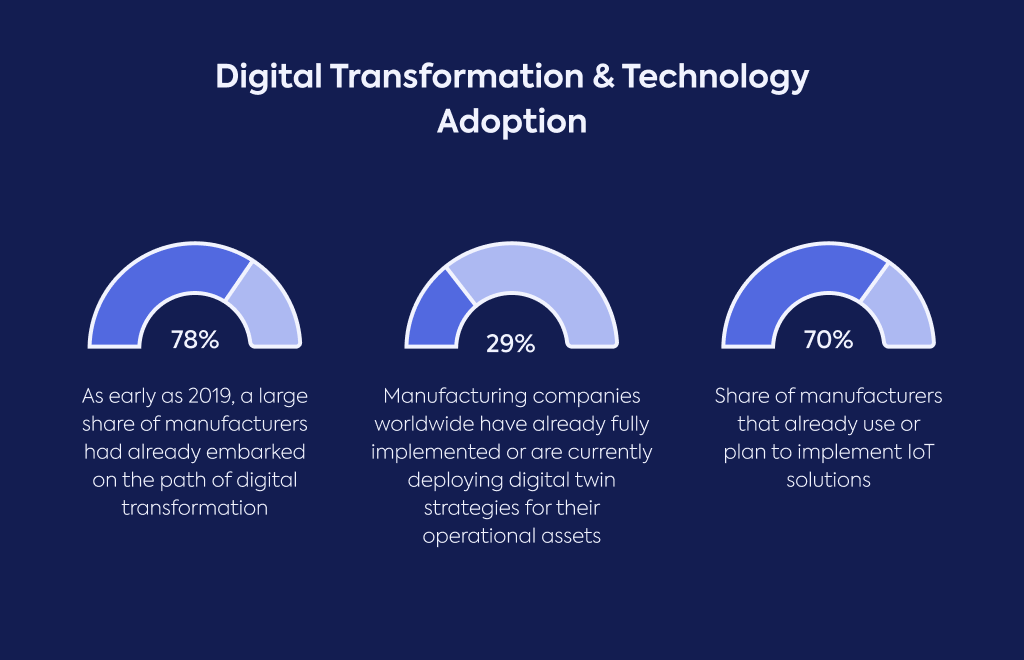

In 2019, 78% of manufacturers had already begun their digital transformation journey.

By 2023, digital transformation initiatives had been launched by 98% of 800 surveyed manufacturers spanning four global regions.

Manufacturing technology investments represented 23% of operating budgets during 2023.

By 2024, technology investments in manufacturing climbed to 30% of operating budgets.

Between 2020 and 2024, the digital twin market expanded by 71%.

Digital twin strategies for operational assets are fully implemented or in progress at 29% of manufacturing companies globally.

Digital twin strategies are in active development or already established at 63% of manufacturing companies worldwide.

IoT solution adoption or planning is underway at over 70% of manufacturers.

In 2024, the worldwide manufacturing operations management software market reached USD 17.46 billion.

By 2033, the global manufacturing operations management software market will expand to USD 76.71 billion.

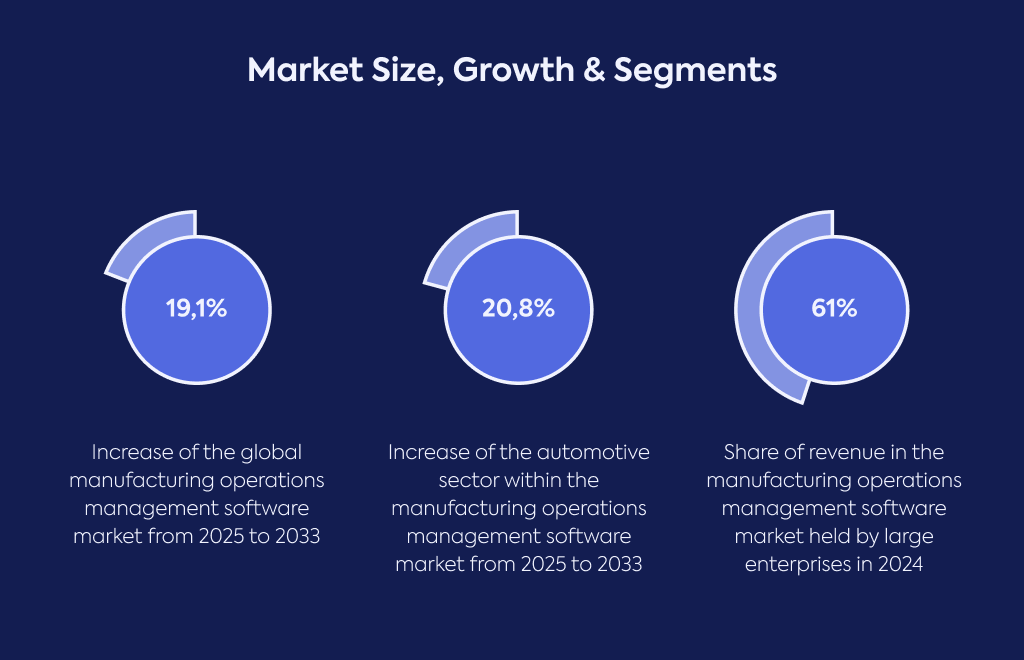

From 2025 through 2033, the worldwide manufacturing operations management software market will advance at a 19.1% CAGR.

North America captured 32.3% of worldwide revenue share in the manufacturing operations management software market during 2024.

The Asia Pacific region's manufacturing operations management software market will achieve the highest growth rate at 21.1% CAGR between 2025 and 2033.

Between 2025 and 2033, the U.S. manufacturing operations management software market will expand at a 15.9% CAGR.

From 2025 to 2033, the automotive sector within manufacturing operations management software will grow at a 20.8% CAGR.

During the forecast period, the services component of manufacturing operations management software will expand at a 20.3% CAGR.

In 2024, large enterprises commanded more than 61.0% of revenue share in the manufacturing operations management software market.

Software components accounted for 71.5% of revenue share in the manufacturing operations management software market during 2024.

SOURCES: