25+ Custom Manufacturing Software Statistics Showcasing Efficiency Gains and Cost Reductions

Key Custom Manufacturing Software StatisticsManufacturing ...

Author:

Tomislav Horvat

· The Custom Accounting Software Market is projected to reach USD 18.7 billion by 2033.

· 94% of accountants have embraced cloud services.

· 64.4% of small business owners use accounting software.

· Almost 75% of accounting tasks can be automated using advanced software.

· Companies that use cloud accounting exclusively saw a 15% growth in the year-over-year revenue pattern.

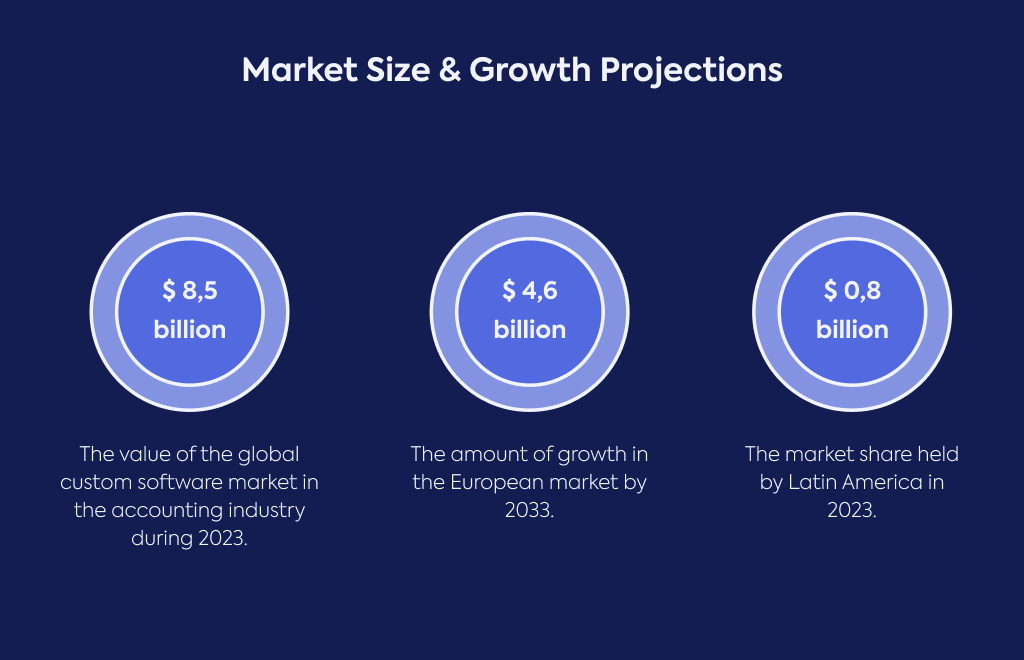

In 2023, the global Custom Accounting Software Market achieved a valuation of USD 8.5 billion.

By 2033, industry forecasts indicate the Custom Accounting Software Market will expand to USD 18.7 billion.

The Custom Accounting Software Market demonstrates robust expansion with a compound annual growth rate (CAGR) of 8.2% spanning the 2025 to 2033 period.

The North American region commanded USD 3.5 billion of the Custom Accounting Software Market in 2023.

North America's Custom Accounting Software Market segment is forecasted to surge to USD 7.4 billion by 2033.

Throughout 2025-2033, North America's Custom Accounting Software Market will advance at a CAGR of 8.1%.

European markets captured USD 2.1 billion in Custom Accounting Software Market value during 2023.

The European Custom Accounting Software Market is anticipated to climb to USD 4.6 billion by 2033.

Europe's Custom Accounting Software Market sector will experience growth at an 8.3% CAGR from 2025-2033.

The Asia Pacific region represented USD 1.3 billion of the Custom Accounting Software Market in 2023.

Asia Pacific's Custom Accounting Software Market is expected to reach USD 3.2 billion by 2033.

The Asia Pacific Custom Accounting Software Market will flourish with an 8.9% CAGR during 2025-2033.

Latin America accounted for USD 0.8 billion in Custom Accounting Software Market size in 2023.

The Latin American Custom Accounting Software Market is set to achieve USD 1.8 billion by 2033.

Latin America's Custom Accounting Software Market will progress at an 8.6% CAGR from 2025-2033.

The Middle East & Africa region held USD 0.8 billion in Custom Accounting Software Market value in 2023.

Middle East & Africa's Custom Accounting Software Market is projected to escalate to USD 2.0 billion by 2033.

The Middle East & Africa Custom Accounting Software Market will advance with the highest 9.0% CAGR from 2025-2033.

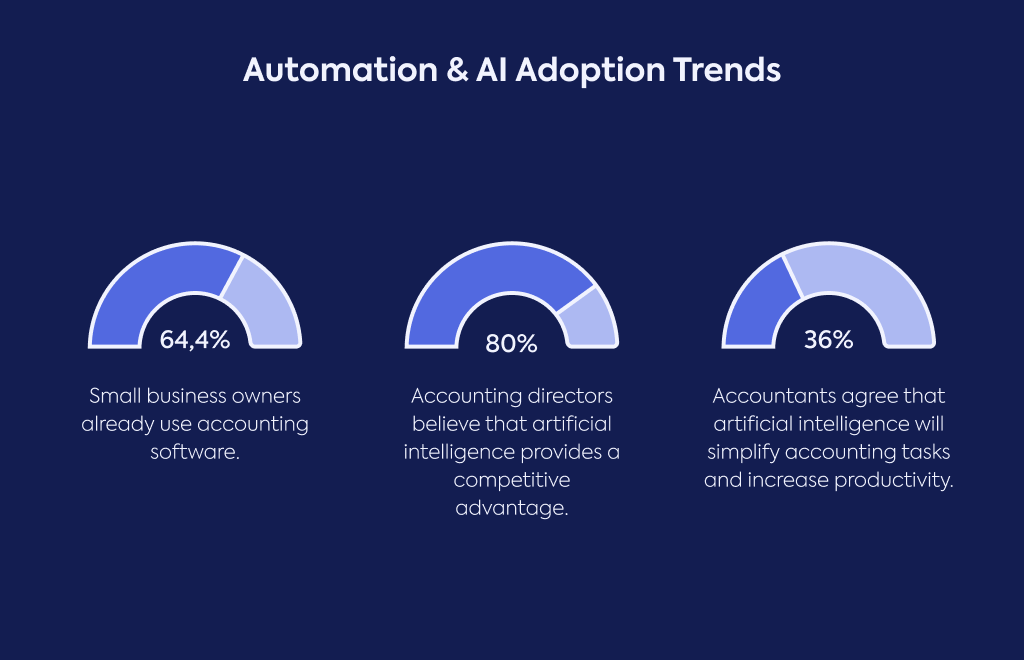

Small business owners demonstrate significant technology adoption, with 64.4% currently utilizing accounting software solutions.

Nearly half of industry professionals, specifically 45%, have declared their plans to automate repetitive and time-consuming accounting processes.

Within the upcoming three years, 58% of accounting professionals are set to implement artificial intelligence solutions for task automation.

A substantial 80% of accounting executives are convinced that AI implementation creates competitive advantage opportunities.

79% of accounting executives maintain that AI technologies can enhance their company's overall productivity levels.

More than one-third of accountants, precisely 36%, agree that Artificial Intelligence will streamline accounting tasks while boosting productivity and efficiency.

An additional 22% of accounting professionals strongly agree that Artificial Intelligence will automate accounting tasks, delivering improved productivity and efficiency.

When seeking advisory services, 68% of clients showed preference for guidance combining both human expertise and Robo adviser capabilities.

The majority of finance professionals, 78%, forecast that complete automation will characterize all future accounting methodologies.

Over 50% of accounting executives anticipate that automated and intelligent accounting system developments will significantly transform accounting businesses throughout the next 30 years.

Advanced software technologies possess the capability to automate almost 75% of current accounting tasks.

The U.S. Bureau of Labor Statistics projects that accounting task automation will decrease the accounting clerk workforce by 10% during the next decade.

Industry projections indicate the cloud accounting market will achieve 4.25 million by 2023.

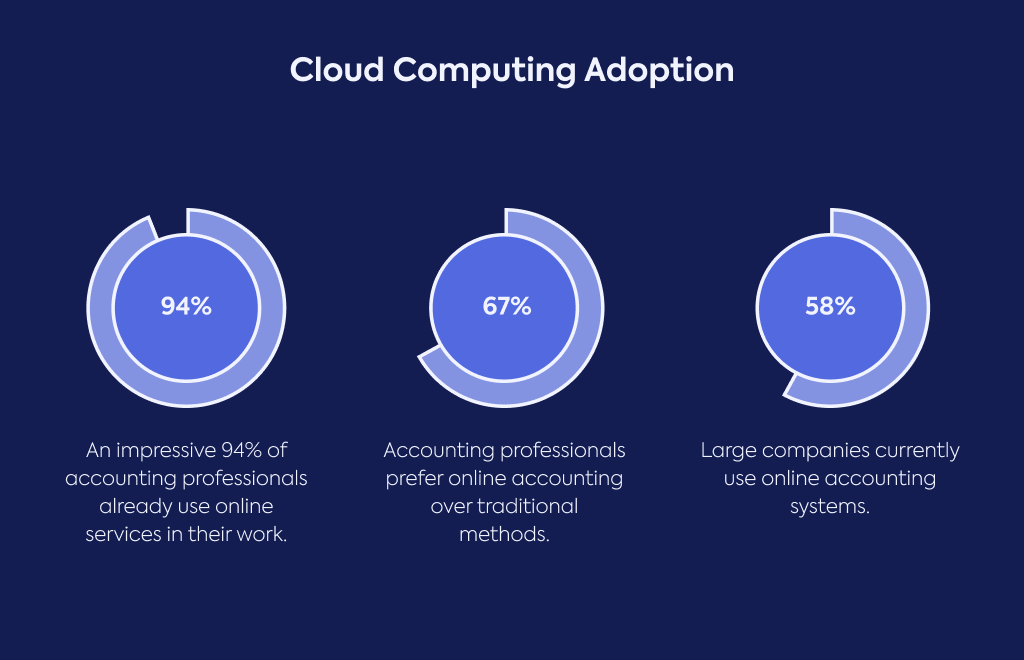

An overwhelming 94% of accounting professionals have successfully adopted cloud services into their practice.

Cloud-based practice management solutions have been implemented by 53% of accountants who have already made the transition.

When comparing methodologies, 67% of accounting professionals favor cloud accounting over traditional approaches.

Large enterprise organizations show significant adoption rates, with 58% currently utilizing cloud accounting systems.

By 2020, 78% of small businesses are projected to operate exclusively through cloud accounting platforms.

Business acceleration through cloud integration has been experienced by 87% of companies that have incorporated cloud technologies into their operational processes.

Small Business Enterprises operating without accounting software face survival challenges, with 20% struggling to maintain operations during their 1st year.

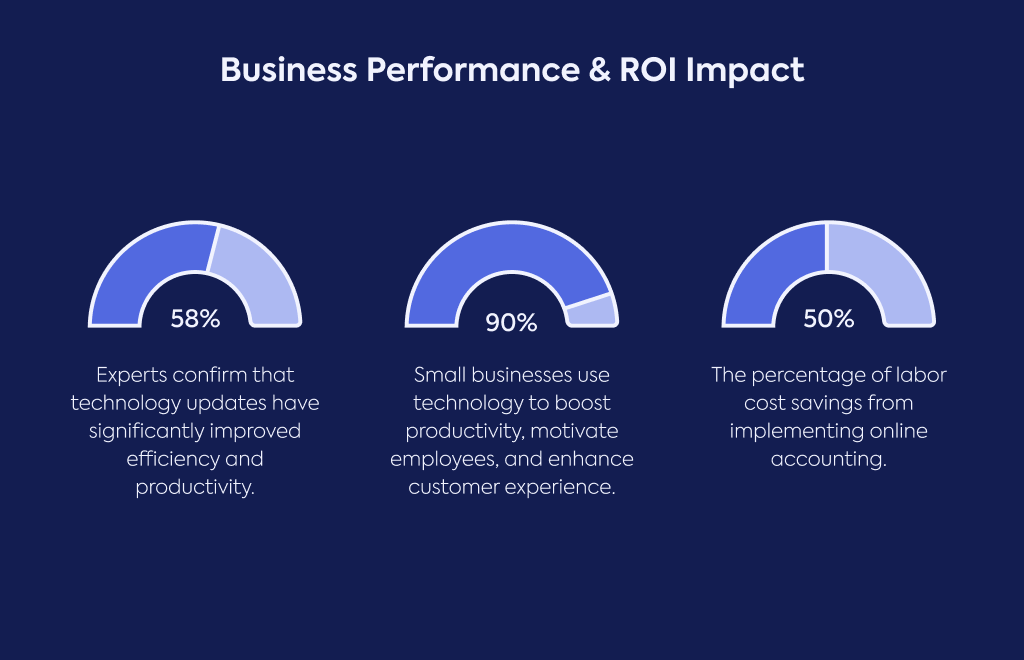

Technology modernization has delivered measurable results, as 58% of professionals confirm that updating technology has substantially improved efficiency and productivity.

The vast majority of professionals, 91%, report that technology empowers them to concentrate on client relationships or amplifies overall productivity levels.

90% of small firms strategically utilize technology to boost productivity, strengthen staff engagement, and elevate the overall client experience.

Large organizations demonstrate even higher adoption rates, with 94% of large firms employing technology to advance productivity, staff engagement, and comprehensive client experience.

Technology's impact on workforce satisfaction is notable, as 60% of large firms attribute enhanced staff engagement and morale to technological implementations.

Manual repetitive task automation through Robotic Process Automation delivers efficiency gains of 44%.

Organizations utilizing cloud accounting as their exclusive solution experienced 15% growth in their year-over-year revenue patterns.

Cloud accounting implementation achieves substantial cost savings, reducing labor expenses by 50%.

Small firms are increasingly turning to technology for seasonal optimization, with 90% seeking technological solutions to achieve an improved tax season.

Large firms show similar technological reliance, as 94% are pursuing technology-driven improvements for enhanced tax season performance.

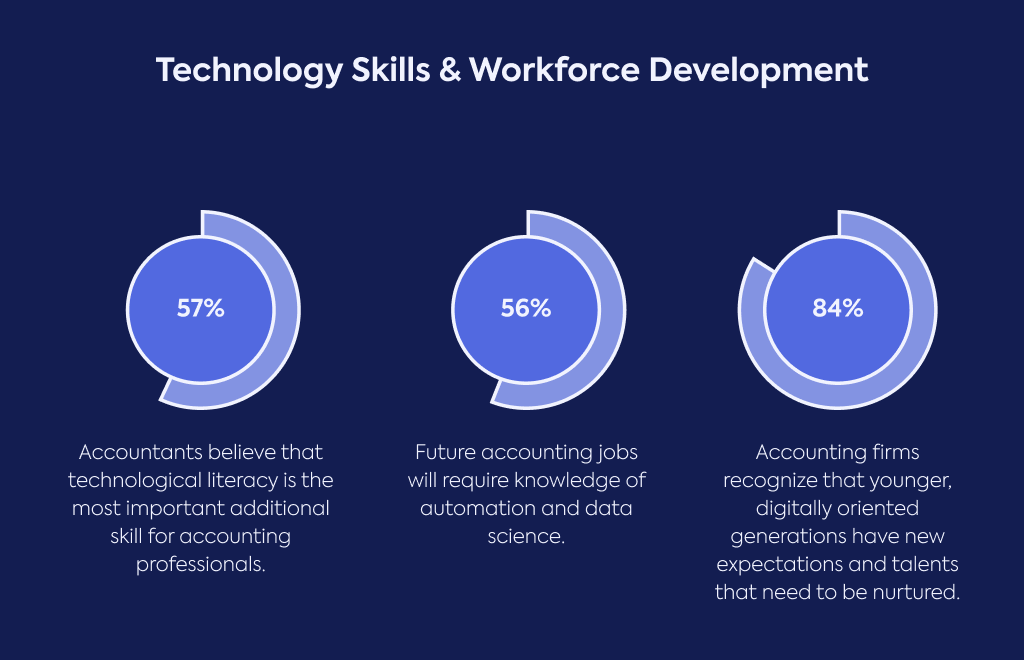

When identifying essential additional competencies for accounting professionals, 57% of accountants recognize technology literacy as the most critical skill requirement.

Looking toward industry evolution, 59% of accounting professionals anticipate that data science and analytics capabilities will become necessary requirements for the accounting sector in the near future.

Future employment opportunities in accounting will demand specialized knowledge, with 56% of upcoming accounting positions requiring proficiency in automation and data science expertise.

The generational shift in workforce expectations is acknowledged by 84% of accounting firms, who recognize that prospective employees from younger generations, as 'digital natives', possess progressive expectations, attitudes and talents that accounting firms must reflect and nurture to successfully attract this talent pool.

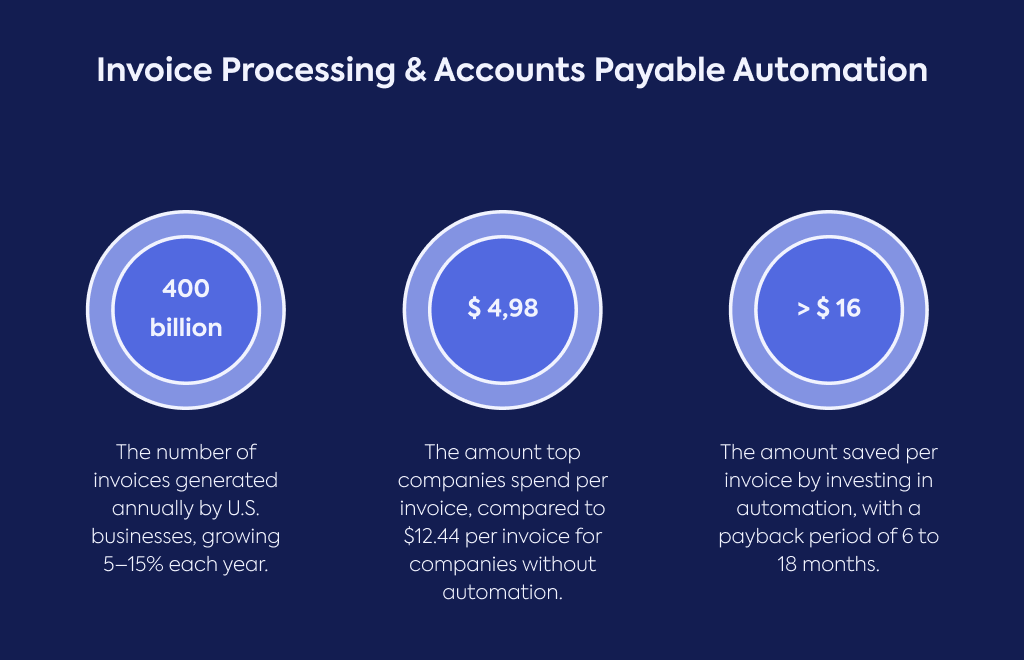

United States businesses produce 400 billion invoices annually, with this volume experiencing continuous growth of 5-15% each year.

Accounts Payable professionals report increased workloads, as 39% have observed approximately 10% growth in their total invoice processing volumes.

Cost efficiency varies dramatically between organizations, with top-performing companies spending $4.98 per invoice, while this expense escalates significantly to $12.44 for organizations that operate without Account Payable automation tools.

Investment in accounts payable automation delivers substantial returns, generating savings of $16 or more per invoice while achieving full cost recovery within 6 to 18 months.

Daily productivity gains are achievable for AP professionals, who can recover one hour per day through automated payment processing and invoice capture systems.

Process automation in Accounts Payable operations eliminates 90-95 percent of paperwork requirements while delivering efficiency improvements of 20-27%.

International competitiveness concerns drive 85% of accountants to believe their country's accounting profession must accelerate technology adoption to maintain global standing.

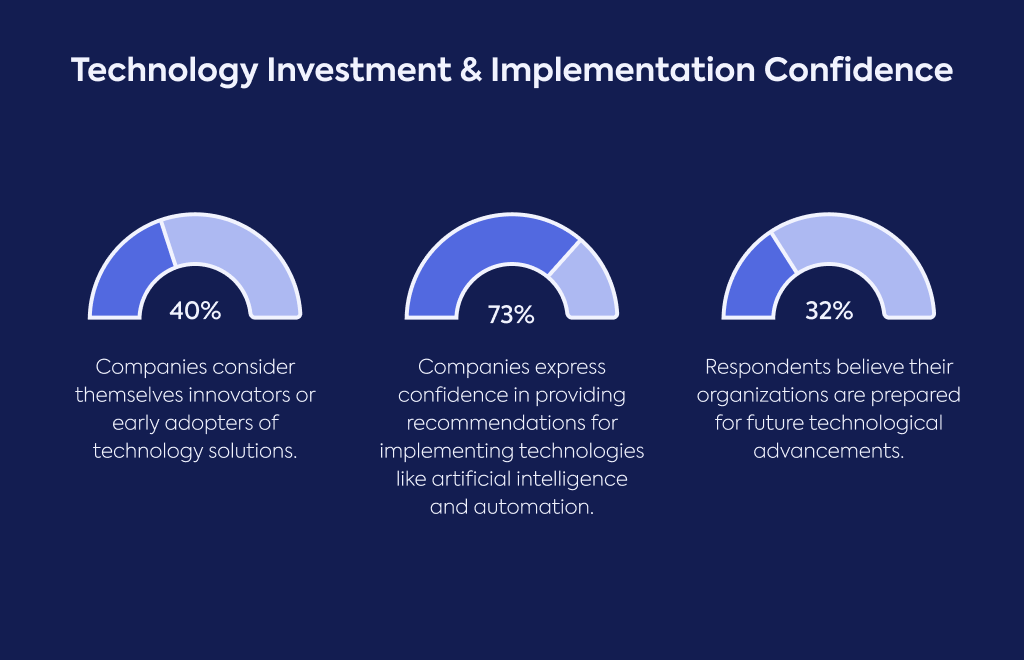

Technology leadership positioning is claimed by almost 40% of firms, who classify themselves as either innovators or early adopters of technological solutions.

Technology value optimization remains limited among small firms, with only 7% believing they are fully maximizing their current technology investments.

Large organizations face similar challenges in technology utilization, as only 2% of large firms consider themselves to be fully maximizing their existing technology value.

Artificial Intelligence investment readiness is demonstrated by 66% of accountants, while 55% have concrete plans for AI implementation within the next 3 years.

Small and midsized firms increased their technology spending, with tech budgets growing by approximately 2% from the previous year.

Contrasting this trend, large firms experienced a 1.6% decrease in their technology budget allocations.

Implementation advisory capabilities are strong across the industry, with 73% of surveyed firms expressing confidence in delivering technology implementation recommendations, including AI and accounting automation guidance.

32% of survey respondents demonstrate extreme confidence that their organizations are strategically positioned to successfully navigate future technology advancements.

Security concerns remain the primary barrier for software adoption, as 38% of businesses that avoid accounting software identify security as their main apprehension.

SOURCES: