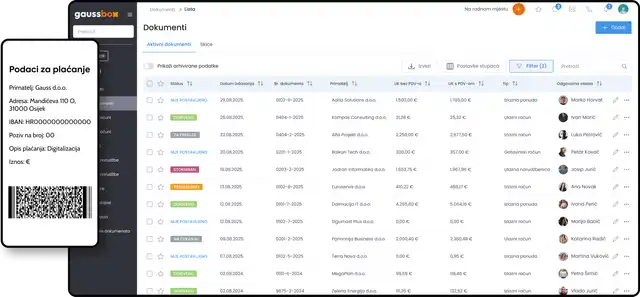

Simple eInvoicing

From January 1st, 2026, eInvoice fiscalization becomes mandatory. Our system makes it simple and legally compliant.

Trusted by

Legal obligations - who, what, and when

See which user groups are subject to mandatory eInvoice fiscalization and when the new regulations take effect.

VAT payers (B2B Companies)

As of January 1st, 2026, all VAT-registered businesses must fiscalize eInvoices in real-time through an authorized intermediary. With our system, this process is automated – no paperwork, no legal guesswork.

SMEs and Freelancers

Starting in 2026, you'll be required to receive eInvoices from your suppliers, and from 2027, issue them as well. Our solution helps you handle both easily, without extra steps or unnecessary complications.

B2C invoice issuers

From September 1st, 2025, all invoices – regardless of payment method – must be fiscalized, including card payments, bank transfers, and others. Our system enables you to handle it quickly, automatically, and in full compliance.

Accounting offices and bookkeepers

Your clients will need to receive and issue eInvoices starting in 2026, and you’ll need access to their fiscalized documents. With our system, everything is in one place – clear, secure, and ready to process.

Tiers and Pricing

Choose the tier that is right for you and your business

*price may vary on project requirements

*price may vary on project requirements

Why choose us?

More than just a tool – stable, scalable, and fully ready for Fiscalization 2.0

.webp)

Got a project in mind? Let's talk business!

Schedule a meetingFrequently asked questions

Fiscalization of all B2C invoices is mandatory from September 1st, 2025, regardless of payment method. As of January 1st, 2026, all VAT payers must fiscalize eInvoices in real-time.

Yes. From 2026, receiving eInvoices is mandatory, and from 2027, issuing them as well. Our Start package covers both – hassle-free.

Start is ideal for small businesses and sole traders – it includes sending, receiving, and fiscalizing eInvoices plus a basic archive. Pro adds advanced modules for documents, projects, CRM, and team collaboration.

Yes. Our system supports integration with leading intermediaries, including Moj-eRačun and FINA eInvoice.

Absolutely. Invoices are stored according to regulations – with fiscal codes, digital signatures, and a minimum 11-year archive.

Yes – demo and consultation are free and non-binding. Setup typically takes 1 to 3 business days, and you can start using the Start package the same day.