25+ Custom Manufacturing Software Statistics Showcasing Efficiency Gains and Cost Reductions

Key Custom Manufacturing Software StatisticsManufacturing ...

Author:

Tomislav Horvat

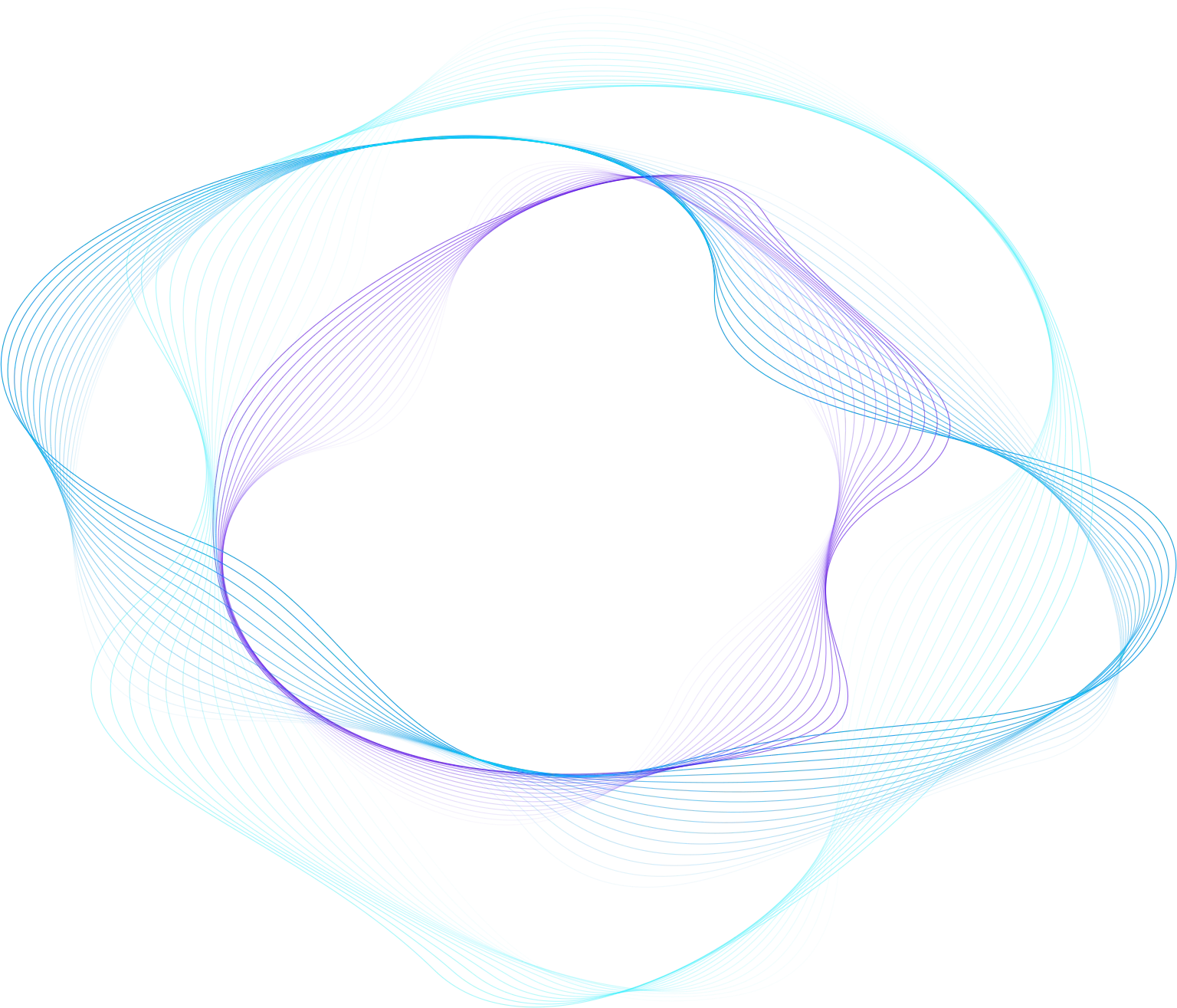

The fintech-software-as-a-service market is exploding from $10.5 billion in 2023 to an estimated $676.9 billion by 2028, with a 16% CAGR driven by demand for digital financial services.

Over 68% of financial companies plan to invest in custom fintech solutions rather than pre-built software within the next 12 months in 2024.

80% of customers are more likely to do business with companies offering personalized experiences.

45% of data leaders at financial institutions have lost customers because of poor personalization in 2024.

When integrated through custom software rather than generic platforms, AI in payments cut fraud by 41% in 2025.

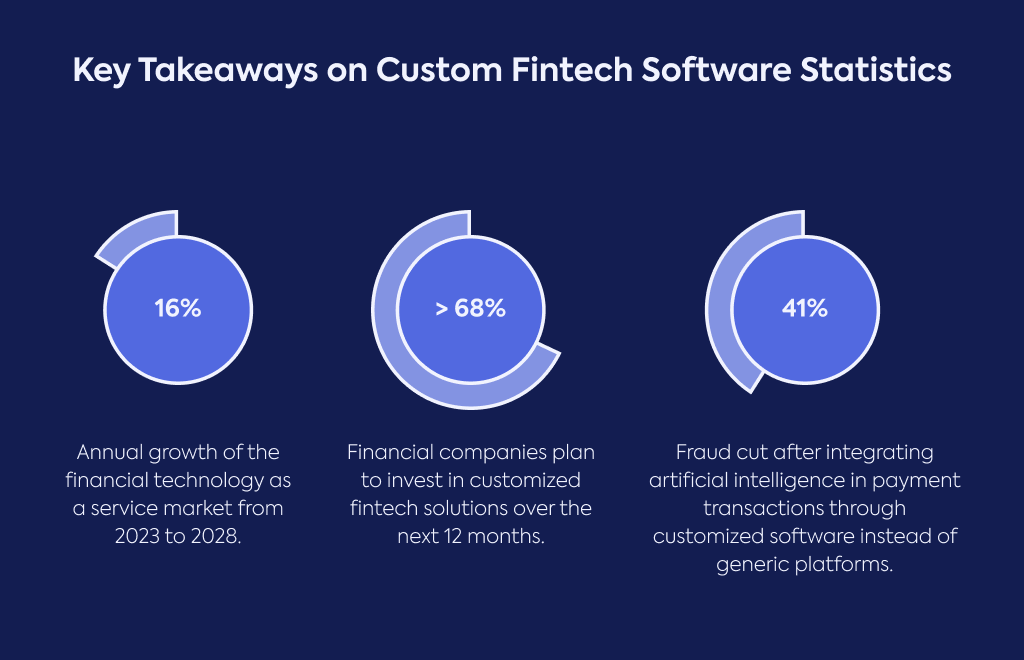

The global Financial Software Market hit USD 205.44 Billion in 2024 and will grow at 8.4% CAGR to reach USD 355.90 Billion by 2032.

Global fintech is on track to reach $608 billion by the end of 2025, with custom development setting the pace.

Custom fintech development alone will reach $92.4 billion by the end of 2025, growing at a hefty 13.6% CAGR.

The fintech-software-as-a-service market is exploding from $10.5 billion in 2023 to an estimated $676.9 billion by 2028, with a 16% CAGR driven by demand for digital financial services.

Traditional banks are seeing 6% annual revenue growth, but fintechs could grow 15% annually from 2023 to 2028.

More than 29,955 fintech startups are operating globally right now.

Since 2019, fintech startups have more than doubled from around 12,000 to over 26,000.

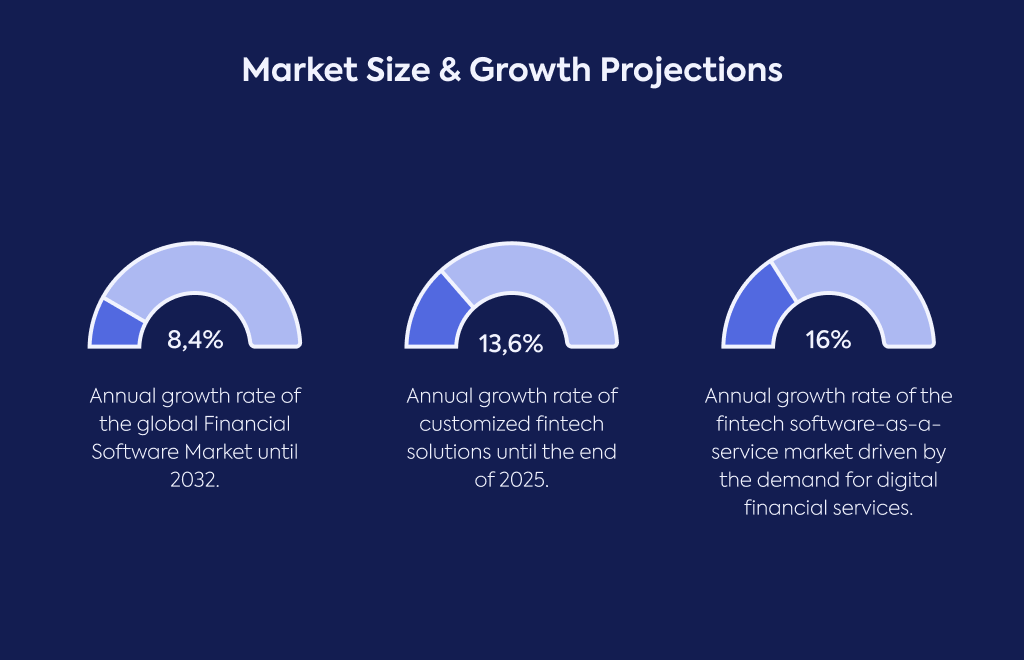

In a 2025 survey, 78% of fintech leaders said regulatory compliance was their top reason for switching to custom software.

Over 68% of financial companies plan to invest in custom fintech solutions rather than pre-built software within the next 12 months in 2024.

A 2024 survey found 63% of fintech companies that adopted Fintech Custom Software Development saw better scalability and data security.

When businesses applied modern Fintech UI/UX Design principles through custom development, user retention jumped by 30%.

80% of customers are more likely to do business with companies offering personalized experiences.

76% get frustrated when personalized interactions don't happen, and 71% of consumers expect companies to deliver them.

While 78% of consumers would keep using their bank if they got personalized support, only 44% of banks actually deliver it.

66% of consumers expect their bank or credit union to know, understand, and reward them, yet just 34% feel their provider treats them as an individual.

More than half of U.S. consumers (54%) want financial providers to use their financial data for personalization in 2024.

48% of consumers would share more data with their financial provider for a better experience, rising to 54% among Gen Z and 58% among Millennials in 2024.

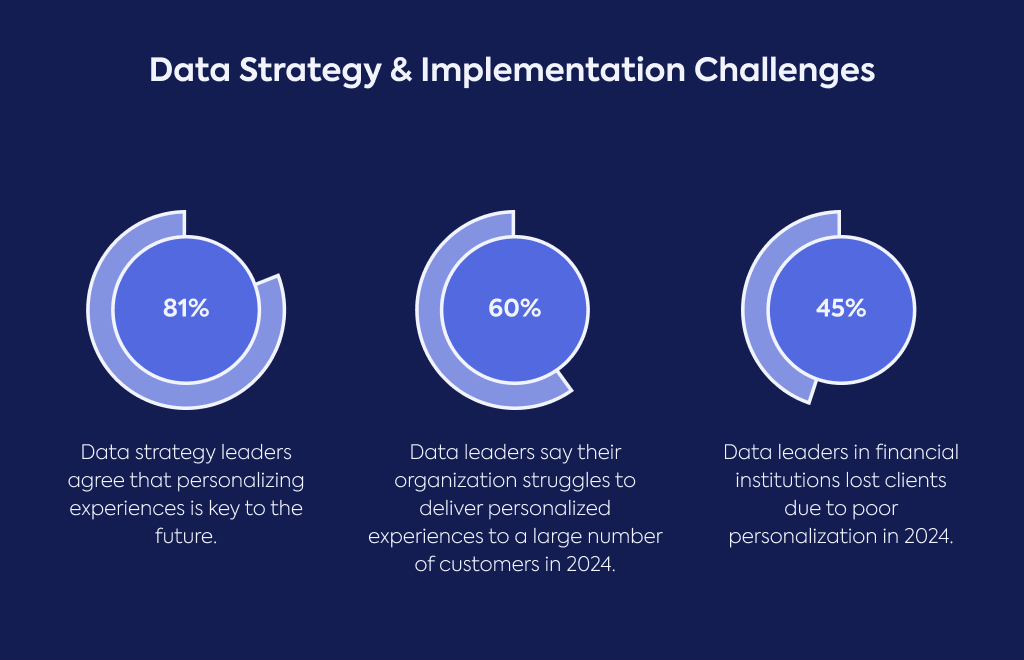

81% of data strategy leaders agree that personalizing experiences based on consumer financial data is essential for the future in 2024.

More than 60% of data leaders say their organization still uses data the same old way in 2024.

60% of data leaders say their organization struggles with delivering personalized experiences at scale to customers in 2024.

45% of data leaders at financial institutions have lost customers because of poor personalization in 2024.

Nearly 1 in 4 (23%) data leaders don't currently use data about their consumers' financial lives to personalize products and services in 2024.

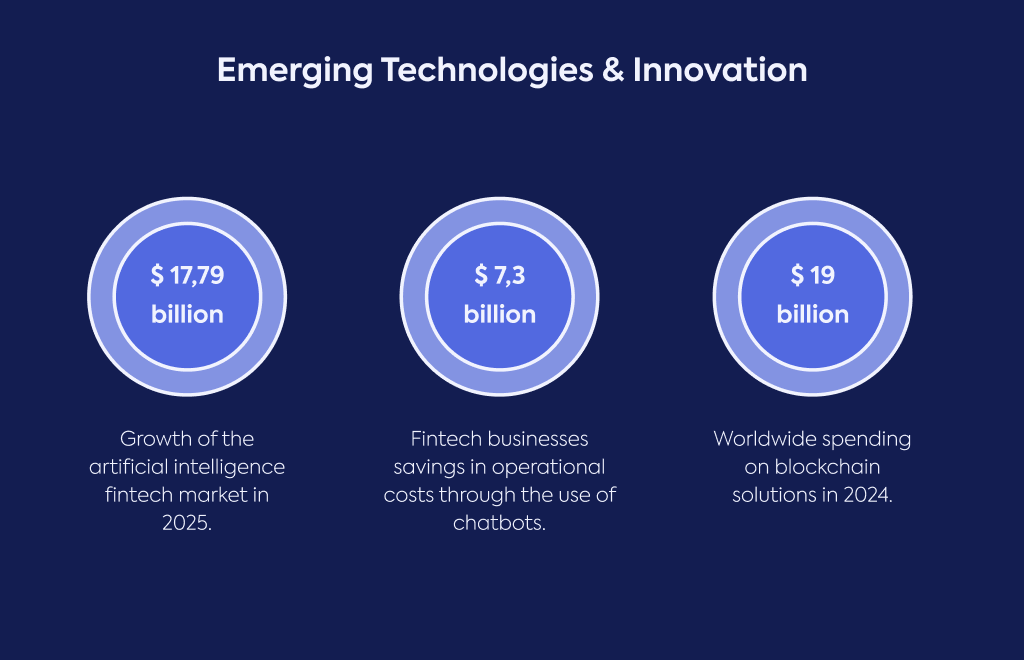

The AI in fintech market will grow from $14.13 billion in 2024 to $17.79 billion in 2025.

When integrated through custom software rather than generic platforms, AI in payments cut fraud by 41% in 2025.

Fintech businesses have saved $7.3 billion in operational costs by using chatbots.

Chatbots have helped fintech companies save an estimated 826 million hours in customer interactions.

Worldwide spending on blockchain solutions will reach $19 billion in 2024, up from $17.9 billion in 2023.

The global blockchain solutions market grew at a 48% CAGR between 2018 and 2024.

SOURCES: