AI in Agriculture: The Most Impressive Use Cases and Benefits Yet

Key takeawaysThe AI in agriculture market is expected to ...

Author:

Tomislav Horvat

AI in finance automates and enhances financial processes, with 85% of financial services providers currently using these technologies to streamline operations and gain competitive advantages.

Key applications include fraud detection using machine learning algorithms, 24/7 customer service through conversational AI, intelligent risk assessment, algorithmic trading, regulatory compliance, robo-advisory for personalized investment, and process automation.

Benefits include operational efficiency (potentially adding $1.2 trillion in value by 2030), enhanced data analysis, improved customer experiences, strengthened security, and competitive innovation advantages.

Successful implementation requires assessing organizational readiness, proper data management, careful technology selection, and thorough model development and testing.

Financial institutions must navigate regulatory requirements, technical integration challenges, and ethical considerations around bias, transparency, and appropriate human oversight.

The world of finance is rapidly evolving thanks to AI in finance technologies.

Artificial intelligence in finance refers to systems that automate and enhance financial processes and services, including machine learning algorithms, natural language processing, and data analytics.

The financial industry is experiencing significant transformation as these technologies reshape everyday operations.

Financial institutions have embraced AI in financial services at an impressive rate.

According to the Cambridge Centre of Alternative Finance, 85% of financial services providers currently use AI, and 77% believe it will be essential to their business within two years.

The financial services industry has recognized that staying competitive means adopting innovative technologies.

AI integration involves four main technological aspects: Artificial Intelligence as a broad field, Machine Learning algorithms that learn from data, systems that create new data similar to training data, and Natural Language Processing that powers chatbot technology.

AI in finance has transformed how information is analyzed and tasks are performed, allowing financial institutions to streamline processes, detect patterns, and extract meaningful insights much faster than humans can.

By 2030, experts at McKinsey & Company predict that AI adoption in financial services will add $1.2 trillion in value.

Data from 2022 shows that 54% of financial institutions either widely used AI or considered it an essential tool, with projections indicating even higher percentages by 2025.

You'll find that integrating AI with existing financial systems isn't always straightforward.

Many institutions use middleware, APIs, and modular architecture to overcome challenges with legacy system integration.

AI systems now serve as the first line of defense against financial fraud.

Machine learning algorithms analyze patterns in transactions to spot suspicious activities and prevent fraudulent actions in real-time.

When you make a purchase that doesn't fit your usual spending pattern, these systems flag it immediately.

Banks and financial organizations leverage AI to scan huge volumes of personal data, helping prevent credit card fraud, money laundering, and other financial breaches.

AI-powered fraud detection systems analyze your buying behaviors, flag unusual purchases, and identify potentially fraudulent transactions as they happen.

JPMorgan Chase demonstrates this technology in action with their credit card business.

They use a proprietary algorithm that examines each transaction's specifics in real-time to spot fraud patterns.

Financial institutions can also detect and mitigate internal cybersecurity risks by analyzing patterns in customers' financial transactions to identify unusual activity.

Conversational AI has revolutionized how you interact with your bank.

Virtual assistants and chatbots handle routine inquiries, account management, and basic transactions using natural language processing to understand what you're asking for.

These tools enhance customer service by answering your queries in real-time, providing 24/7 support, and freeing up human resources for more complex tasks.

Bank of America's chatbot has served tens of millions of customers by answering almost one million different questions.

The customer experience improves when chatbots efficiently provide account information, password assistance, and gather context from your past interactions to predict your needs.

HSBC took this approach further by implementing an AI robot called 'Pepper' to interact with customers in branches, helping with basic banking tasks and queries.

Financial institutions now use AI models to enhance credit risk assessment.

These systems analyze extensive financial data, including credit history, statements, and market trends, to evaluate risks associated with extending credit.

Credit scores are just one factor these models consider.

They can accurately estimate your creditworthiness by examining transaction history, income growth, market conditions, and many other factors.

MasterCard uses Decision Intelligence technology to assess credit risk of each transaction in real-time.

Historical data powers these predictive analytics systems, providing detailed insights on micro activities and behavior to determine if investments should occur.

In the insurance sector, risk management has been transformed through advanced predictive modeling, allowing insurers to gauge potential liabilities more accurately.

Investment strategies have been transformed by AI systems that analyze market data, historical price trends, indicators, and news sentiment to identify patterns and predict market movements.

Volumes of financial data that would overwhelm human analysts are processed in seconds.

These use cases for AI show how finance tools can outperform human traders by making faster and better trading decisions, with the ability to scan millions of data points in real-time.

Virtu Financial uses AI to power its algorithmic trading platform, which executes trades at optimal times and prices based on predefined strategies and risk parameters.

Machine learning algorithms in trading continuously learn and adapt to market conditions, dynamically adjusting strategies based on real-time data.

Virtual assistants also process natural language queries from traders and provide real-time market insights.

Many hedge funds use these systems for comprehensive market analysis, allowing them to build their own trading systems.

Investment advice has also been revolutionized, with AI-powered systems providing guidance based on vast amounts of analyzed data.

Financial reporting has become more accurate and efficient with AI systems that take into account all relevant regulations, detect deviations, analyze data, and follow rules accurately.

This helps financial institutions comply with complex laws without overwhelming their staff.

Deutsche Bank has implemented AI across its compliance and risk management sectors, specifically for anti-money laundering and Know Your Customer processes.

The use of AI in monitoring tools continuously tracks financial transactions and processes to ensure regulatory compliance, reducing the burden on finance teams.

These systems automate regulatory reporting by extracting relevant data, performing calculations, and generating financial statements that comply with standards.

Custom AI-powered search engines analyze keyword searches within filings, transcripts, and other financial documents to compare customer documentation to existing regulations.

Ethical AI considerations are particularly important in this area, as these systems must operate with transparency and fairness while maintaining compliance.

Personalized financial advice is now available to more people than ever through AI-powered systems.

Robo-advisory uses AI to provide investment recommendations based on your individual goals and risk preferences, automating the investment process.

These tools offer personalized investment guidance based on your financial goals, risk tolerance, and market conditions through sophisticated algorithms.

Charles Schwab's Intelligent Portfolios utilizes AI to build and manage diversified portfolios based on these individual factors.

Financial planning has become more accessible as BlackRock's Aladdin platform analyzes massive amounts of data, identifies risks and opportunities, and provides investment managers with real-time insights.

The growing interest in passive investment has prompted finance companies to invest in AI solutions, making it possible for people unfamiliar with finance to make investments.

Robo-advisory is also more cost-effective for financial institutions compared to human asset managers while still providing tailored wealth management services.

Financial operations have been streamlined through AI tools that handle tasks traditionally done manually by bank employees.

These systems prepare documents, access information for clients, and verify personal ID by checking the match between an ID and a picture.

Finance AI technologies automate data entry, document processing, and reconciliation, reducing manual effort and improving accuracy.

You'll find that many routine processes like account updates, login issues, lost or stolen cards, and card activation can now be handled with minimal human intervention.

When you streamline operations with AI, you enhance efficiency by automating repetitive processes, reducing human errors, and freeing up resources for strategically important tasks.

Financial institutions can automate close processes, reducing manual tasks, minimizing errors, and accelerating the preparation of financial statements.

The benefits of AI in finance include substantial cost reductions through back-office automation, streamlined operations, and reduced overhead expenses.

Process automation reduces manual labor requirements, allowing financial organizations to repurpose human capital for more important tasks.

When you implement AI, you'll see improvements in efficiency in financial processes.

The technology handles routine tasks like transaction processing and data entry, minimizing human errors and ensuring data correctness.

AI enables faster preparation of financial statements and regulatory reports.

The use of AI in finance has significant financial implications.

Citibank forecasts that AI could boost global banking profits by $170 billion by 2028 through increased efficiency and reduced costs.

These systems improve resource utilization and reduce operational costs, creating a more productive financial environment.

AI capabilities now allow financial institutions to conduct large-scale analyses of structured and unstructured datasets, recognizing patterns and extracting insights that humans might miss.

Machine learning in finance enables processing and analyzing vast amounts of data, providing actionable insights much faster than manual methods.

The application of artificial intelligence in analyzing customer interactions reveals patterns among different service metrics without requiring internal teams to dig through data manually.

These systems analyze sentiment from social media posts, reviews, and customer feedback, providing valuable insights into preferences and market trends.

AI enhances financial forecasting by analyzing historical data patterns to accurately predict future trends, helping organizations make informed decisions.

Advanced algorithms integrate sentiment analysis from social media platforms, providing a comprehensive view of market dynamics.

Financial institutions that offer tailored services through AI see significant benefits in customer satisfaction and loyalty.

AI personalizes financial services by analyzing behavior and preferences to provide recommendations that enhance engagement.

AI-powered chatbots and virtual assistants provide round-the-clock support, ensuring services are always accessible regardless of location or time zone.

This personalization improves satisfaction and contributes to revenue growth through increased customer retention and acquisition.

According to the Zendesk Customer Experience Trends Report 2024, 69% of CX leaders say AI can help make digital interactions more human.

Their AI-powered report indicates that AI will soon touch 100% of customer interactions and solve 80% independently.

Financial products and services have evolved thanks to AI, enabling institutions to create innovative financial products and personalized experiences, positioning them at the forefront of industry advancements.

The cases for AI in finance are particularly compelling in security and risk management.

AI enhances security with algorithms that authenticate customer identities and can lock cards or block transactions when detecting potentially fraudulent activity.

AI in the finance industry includes anomaly detection algorithms that identify unusual patterns and deviations from normal behavior, raising alerts for potential fraud cases.

AI improves risk management by analyzing complex data sets to identify various types of risks, including credit, market, and operational risk.

Financial solutions powered by AI facilitate early fraud detection, providing a crucial defense against financial crimes.

These systems use encryption and machine learning to authenticate identities, building trust through prioritized customer data privacy.

They even enable dynamic premium pricing models in insurance based on AI-derived risk factors, ensuring more accurate pricing.

Financial institutions need to start implementing AI by defining specific objectives.

You should consider what you want to achieve, whether it's enhancing fraud detection, automating customer service, or optimizing investment strategies.

Identifying relevant AI use cases that align with your business goals ensures targeted and impactful applications.

You need to evaluate your existing technical infrastructure, including data storage capabilities, processing power, and compatibility with AI frameworks.

The path to successful AI adoption requires assessing the skills and knowledge of your current workforce to determine if additional training or hiring is needed.

Financial forecasts can help determine the expected return on investment and the budget needed for implementation.

Financial institutions need to start implementing AI by defining specific objectives.

You should consider what you want to achieve, whether it's enhancing fraud detection, automating customer service, or optimizing investment strategies.

Identifying relevant AI use cases that align with your business goals ensures targeted and impactful applications.

You need to evaluate your existing technical infrastructure, including data storage capabilities, processing power, and compatibility with AI frameworks.

The path to successful AI adoption requires assessing the skills and knowledge of your current workforce to determine if additional training or hiring is needed.

Financial forecasts can help determine the expected return on investment and the budget needed for implementation.

The applications of AI in finance depend heavily on proper data preparation.

You need to gather necessary data from diverse sources, ensuring it's accurate, clean, and relevant to your chosen use cases.

Finance involves working with sensitive information, so data preparation - including collection, cleansing, normalization, and labeling - is crucial for training AI models.

You should implement rigorous quality assurance processes and robust security measures to maintain the integrity of operations.

When using AI in finance, you need comprehensive data governance frameworks to ensure privacy and protect sensitive information.

Financial AI models require high-quality, diverse datasets for training to reflect changing customer behaviors and market conditions.

Selecting the right AI frameworks is a critical step in supporting finance AI development.

You need to consider data storage, processing power, and frameworks that best suit your specific needs.

Ensure that AI for financial applications integrates seamlessly with your current systems and workflows, like CRM platforms and transaction processing systems.

Using middleware and APIs helps with smooth integration with legacy systems, and you should consider modular and scalable architectures.

Generative AI in finance offers new possibilities for content creation, data simulation, and scenario analysis.

You might want to partner with a reputed development company to develop and train models tailored to your specific use cases.

Consider cloud solutions to address the computational resources required for AI workloads, while navigating regulatory constraints on data security.

Artificial intelligence technologies continue to evolve, so your technology selection should allow for future advancements.

The future of AI depends on proper development and testing.

You should develop and train models specifically tailored to your institution's use cases and objectives.

Testing AI models in real-world scenarios validates their effectiveness and reliability before full deployment.

Address any issues, errors, bugs, or discrepancies during testing to minimize risks associated with implementation.

Use interpretable techniques, including explainable machine learning algorithms, to improve transparency and confidence in AI systems.

Continuously monitor model performance after deployment and provide regular maintenance and updates to adapt to changing business needs.

The future of AI in finance will be shaped by how well financial institutions implement these technologies today.

Organizations should prioritize ethical concepts throughout the development lifecycle and establish robust governance structures for compliance monitoring.

AI for financial services will continue to evolve, requiring regular updates and refinements to models and processes.

This ongoing commitment ensures that your AI implementations stay relevant and effective.

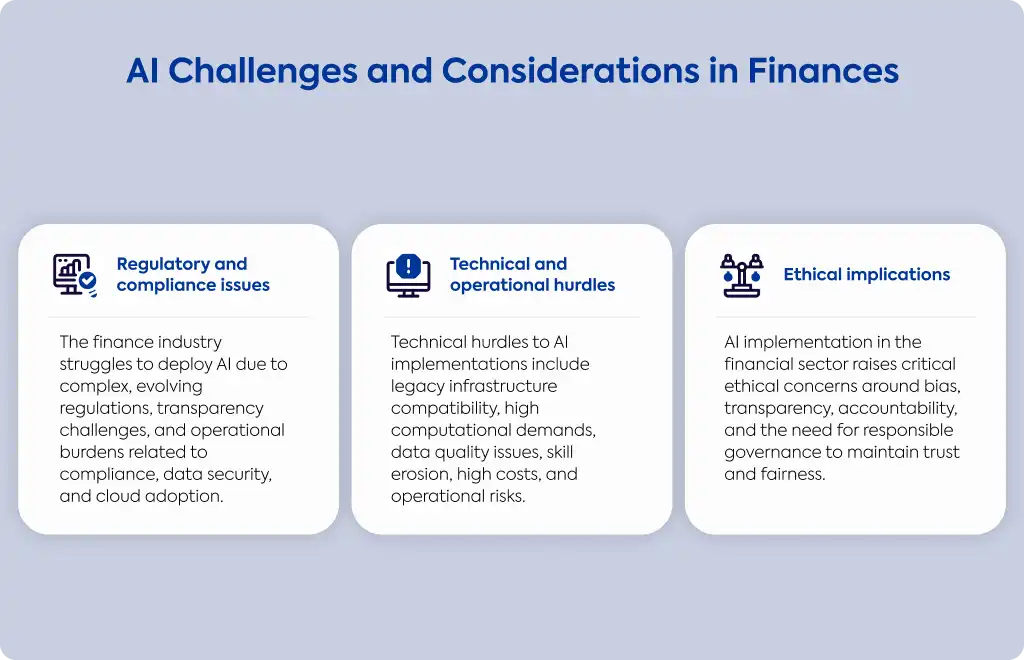

The finance industry faces substantial regulatory hurdles when deploying AI systems.

These systems must adhere to stringent regulations governing operations from credit decisioning to trade surveillance.

Lack of transparency in AI decision-making processes (often called the "black box" problem) can make demonstrating compliance difficult.

Implementing comprehensive record-keeping and model documentation protocols imposes significant operational overhead.

AI in the financial services sector must navigate regulatory mandates concerning data security and residency, creating significant barriers to cloud adoption.

AI in the financial services industry must evolve with changing regulatory landscapes to ensure implementations don't expose companies to legal risks.

AI algorithms present integration challenges when combined with legacy IT infrastructure, often requiring substantial re-engineering of existing processes.

AI workloads in finance demand substantial computational resources due to massive data volumes and intensive model training needs.

Financial management becomes complicated when data quality and availability issues arise for training AI models due to disparate sources and inconsistencies.

Over-reliance on AI systems can reduce human oversight and lead to the erosion of critical financial skills within organizations.

Implementing and maintaining AI financial systems can be expensive, with risks that investments may not yield expected returns if the technology underperforms.

These systems can fail or produce incorrect outputs due to technical errors, faulty algorithms, or unforeseen circumstances, potentially disrupting operations or resulting in financial losses.

Financial solutions powered by AI require ongoing maintenance and updates, adding to the long-term cost and resource requirements.

Organizations must carefully weigh these challenges against the potential benefits.

AI enables powerful capabilities but raises important ethical questions.

Algorithms can inadvertently perpetuate biases present in training data, leading to unfair outcomes in financial decisions such as loan approvals or credit scoring.

AI solutions must prioritize fairness in training data around customer information like credit scores or lending decisions to mitigate bias.

Transparency should be at the forefront of operations by explaining the use of AI and potential benefits to help customers understand how their information is used.

Since AI models frequently function as "black boxes," when a company uses AI, it can be difficult to understand decisions and explain results, which is important in regulated financial contexts.

Financial services businesses should balance adopting AI with developing human expertise and ensure staff are trained to work effectively alongside these technologies.

AI helps streamline processes, but raises ethical concerns around fairness, accountability, and transparency.

AI provides significant benefits when properly implemented, but requires robust governance structures throughout the development lifecycle.

AI has revolutionized many aspects of financial services, but responsible implementation requires careful consideration of these ethical dimensions.

By addressing these concerns proactively, financial institutions can harness the power of AI while maintaining trust and integrity.

Implementing AI offers game-changing benefits from fraud detection to intelligent risk assessment, but legacy systems, regulatory hurdles, and ethical concerns can create roadblocks.

At Gauss, we craft custom AI solutions tailored specifically for financial institutions.

From Algorithm to Alchemy: Turning Financial Data into Gold

Custom AI Development that integrates seamlessly with your existing systems

Compliance-First Approach ensuring transparency and regulatory alignment

End-to-End Support from strategy through implementation and beyond

Don't let technical complexities prevent you from capturing AI's competitive edge.

Partner with Gauss and transform your financial operations today.