Top 10 Public Sector Mobile App Development Companies

Key Takeaways on Top Public Sector Mobile App Development ...

Author:

Tomislav Horvat

The B2B eCommerce market is currently valued at $18.8 trillion, with projections to reach $20.9 trillion by 2024 and surpass $36 trillion in GMV by 2026, showcasing a compound annual growth rate of 14.5%.

By 2025, 80% of all B2B sales interactions are expected to take place through digital platforms, with 56% of B2B organizations’ revenue coming from digital channels.

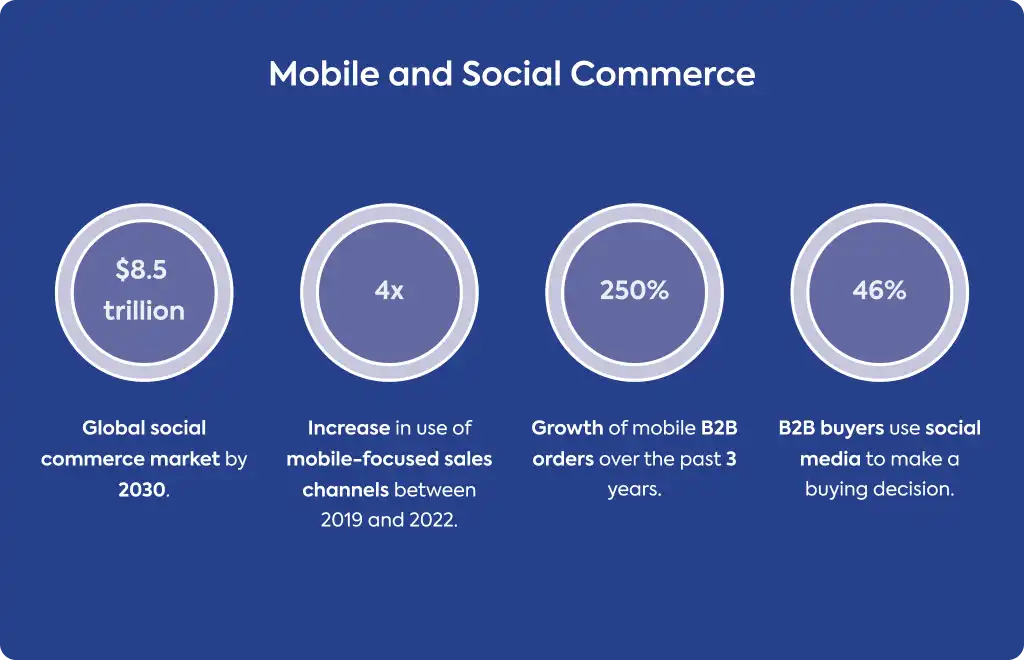

The global social commerce market is anticipated to reach an extraordinary $8.5 trillion by 2030, redefining the role of social platforms in the B2B landscape.

87% of B2B buyers are willing to pay more for suppliers who deliver an outstanding customer experience, emphasizing the critical role of service quality in the competitive market.

Digital channels will drive 80% of B2B sales by 2025, a significant leap from 13% in 2019, underscoring the sector’s rapid digital transformation.

75% of B2B buyers use social media platforms to inform their purchasing decisions, highlighting the growing importance of social commerce and digital insights.

The U.S. B2B eCommerce market is expanding at a compound annual growth rate of 10.7%, with sales expected to climb from $1.7 trillion in 2021 to $3 trillion by 2027.

The B2B eCommerce market is currently valued at $18.8 trillion, reflecting its massive scale and influence.

By 2024, the global B2B eCommerce market is expected to reach an impressive $20.9 trillion, highlighting its continued growth.

With an annual growth rate of 14.5%, the global B2B eCommerce market is forecasted to surpass $36 trillion in GMV by 2026.

The global B2B eCommerce market is projected to grow at a compound annual rate of 20.2% from 2023 to 2030.

Europe’s B2B eCommerce GMV is anticipated to exceed $1.8 trillion by 2025, solidifying its strong presence in the sector.

In North America, the B2B eCommerce market is forecasted to cross $4,600 billion by 2025, showcasing robust regional performance.

According to Forrester, U.S. B2B eCommerce sales are predicted to climb to $3 trillion by 2027, illustrating its steady expansion.

Back in 2021, U.S. B2B eCommerce sales amounted to $1.7 trillion, marking a pivotal year for the market.

The share of U.S. B2B eCommerce in total B2B sales is set to grow from 17% in 2022 to 24% by 2027, reflecting a significant digital shift.

The U.S. B2B eCommerce market is expanding at a compound annual growth rate of 10.7%, showcasing sustained growth.

By 2027, the U.S. B2B eCommerce industry will see in-person sales exceed $3 billion, growing at an annual rate of 10.7%.

In the U.S., mobile devices are projected to drive over $710 billion in B2B eCommerce sales by 2025.

The UK’s B2B eCommerce market, valued at $141.4 billion in 2022, is forecasted to exceed $167.42 billion by 2025.

China’s online B2B market hit $1.2 billion in 2023, with cross-border eCommerce growing at an annual rate of 8.2%.

By 2026, 27% of global retail sales will come from eCommerce, up from 22% in 2021, with B2B playing a significant role.

Digital channels are expected to generate 80% of B2B sales by 2025, a dramatic rise from 13% in 2019.

By 2025, 56% of B2B organizations’ revenue will come from digital channels, up from 32% in 2020.

In 2024, 70% of enterprise marketplaces are expected to participate in B2B transactions.

The market for predictive analytics software is projected to reach $27.21 billion by 2030, enhancing decision-making in B2B.

The VR market is set to grow from $12 billion to $22 billion by 2025, opening new frontiers for B2B eCommerce.

By 2030, the global social commerce market is anticipated to reach a staggering $8.5 trillion, redefining online business landscapes.

By 2025, 80% of all B2B sales interactions are expected to take place through digital platforms.

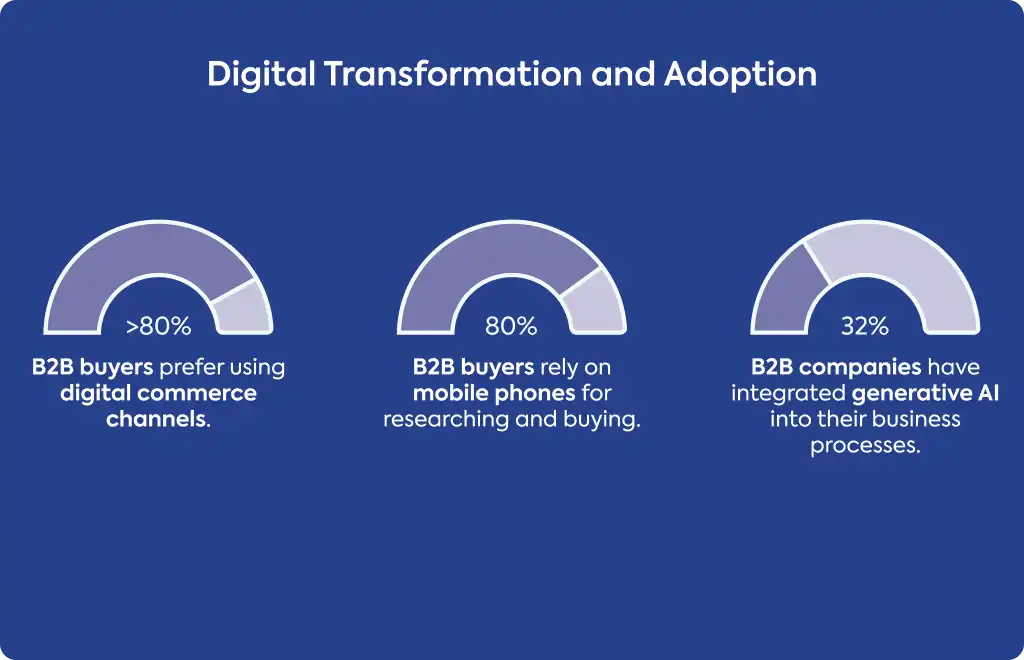

Over 80% of B2B buyers prefer using digital commerce channels for ordering and payments.

During working hours, 80% of B2B buyers rely on mobile devices for researching and making purchases.

In 2020, 87% of B2B purchases were linked to mobile app usage.

Two-thirds of B2B companies across various industries now provide eCommerce capabilities.

Nearly 50% of companies in a survey attribute their success in B2B eCommerce to leveraging marketplaces.

By 2025, Amazon Business is projected to exceed a GMV of $83.1 billion, with 6 in 10 B2B buyers conducting over a quarter of their purchasing on the platform.

Self-directed interactions in B2B buying are now outpacing human-led ones, with a ratio of 15 to 12.

56% of B2B revenue in the UK is forecasted to come from digital channels by 2024.

In a McKinsey survey, 38% of top performers credited the launch of new digital sales channels for their market gains.

74% of organizations believe falling behind in modern commerce solutions could harm their business outcomes.

By 2025, 50% of Chief Sales Officers aim to transition from managing sellers to leading the selling process.

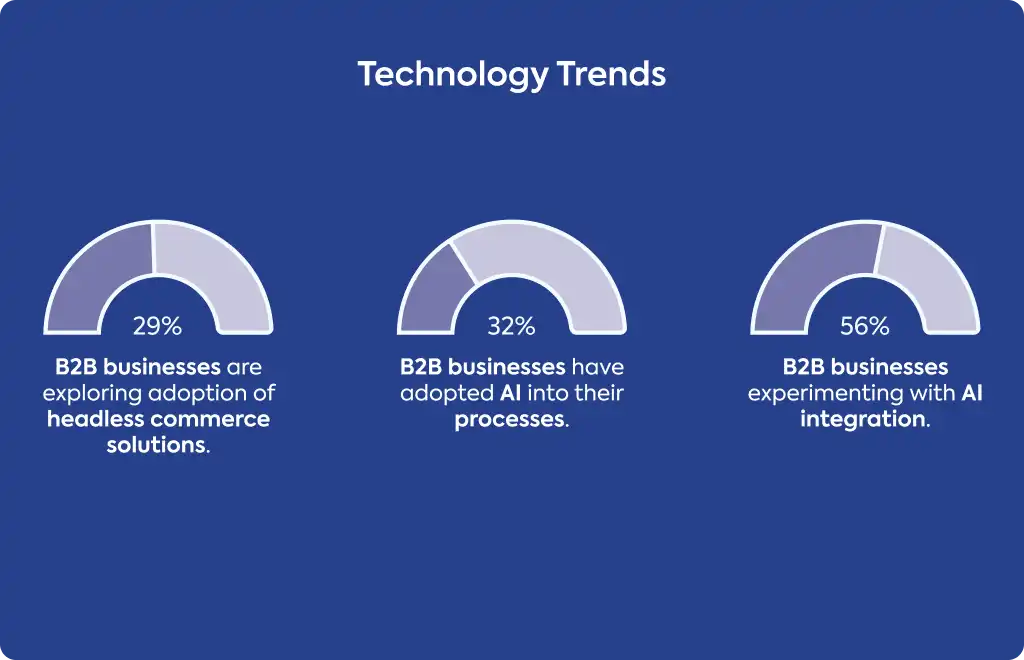

In 2023, one in four B2B organizations implemented AI technology into their eCommerce strategies, while 56% are actively exploring AI.

45% of B2B companies have begun testing generative AI for potential business use.

32% of B2B companies have fully integrated generative AI into their operations.

40% of B2B organizations are considering replatforming to enhance their business performance and capabilities.

77% of companies with headless architecture report faster storefront updates, while 34% of businesses face delays of weeks or months in making digital storefront changes.

77% of businesses using headless technology successfully expand into new channels, compared to 54% of non-headless companies.

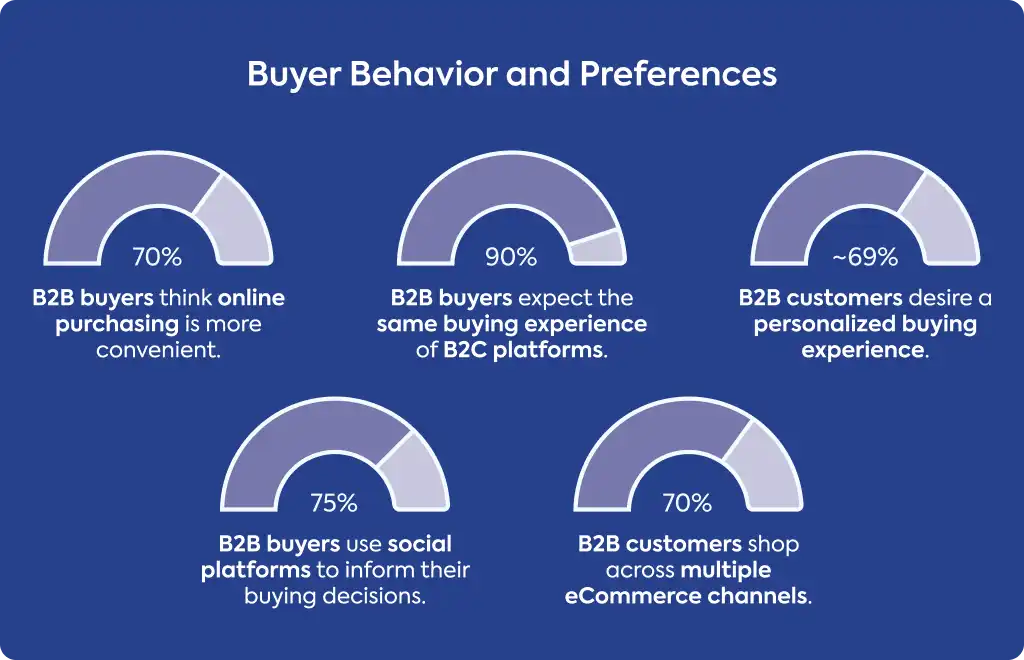

70% of B2B buyers report that online purchasing is more convenient and is their preferred method.

90% of global B2B buyers expect an online shopping experience as seamless and user-friendly as B2C platforms.

A significant 83% of B2B buyers prefer handling orders and accounts online, with 100% seeking self-service options for at least part of the buying process.

87% of B2B buyers are willing to pay more for suppliers who deliver an outstanding customer experience.

82% of B2B decision-makers prefer suppliers that provide a performance guarantee, emphasizing the importance of trust.

Online research influences 89% of B2B buyers, highlighting the critical role of digital insights in purchasing decisions.

66% of B2B buyers expect content to be fully or mostly personalized when exploring products or services.

Nearly 69% of B2B customers desire a personalized buying experience akin to shopping on Amazon.

75% of B2B buyers use social platforms to inform their purchasing decisions, showcasing the growing importance of social commerce.

A notable 81% of buyers prefer self-service tools over direct communication with sales representatives.

62% of consumers are less inclined to buy from a brand that offers a poor mobile shopping experience.

70% of B2B buyers shop across multiple eCommerce channels, reflecting the diversity of their purchasing habits.

B2B buyers utilize an average of 10 sales channels when researching products or services.

Millennials and Gen Z now account for 64% of B2B buyers, representing a significant generational shift.

By next year, 70% of B2B buyers are projected to be Millennials, underscoring their growing influence in the market.

44% of Millennials prefer completing their purchases without interacting with a sales representative.

Two-thirds of B2B buyers are ready to spend over $50,000 without requiring salesperson assistance.

The proportion of B2B purchasing decisions involving two to three stakeholders increased from 38% in 2023 to 41% in 2024.

The percentage of decision-makers ready to spend $10 million or more on eCommerce transactions surged by 83%.

Recurring orders not only indicate high customer satisfaction but also create a reliable revenue source for B2B sellers.

90% of surveyed buyers would recommend a product if their experience searching for information and content was positive.

By 2023, 77% of B2B buyers opted to complete their transactions through digital channels.

By 2024, 56% of B2B revenue in the UK is anticipated to be generated through digital channels, underscoring the sector's digital transformation.

Among the largest share winners in a McKinsey survey, 38% identified introducing new digital sales channels as a cornerstone of their success strategy.

37% of respondents emphasized that experimenting with new sales channels significantly enhanced their digital strategies.

A notable 75% of B2B buyers rely on social platforms to inform their purchasing decisions, highlighting the growing influence of social media.

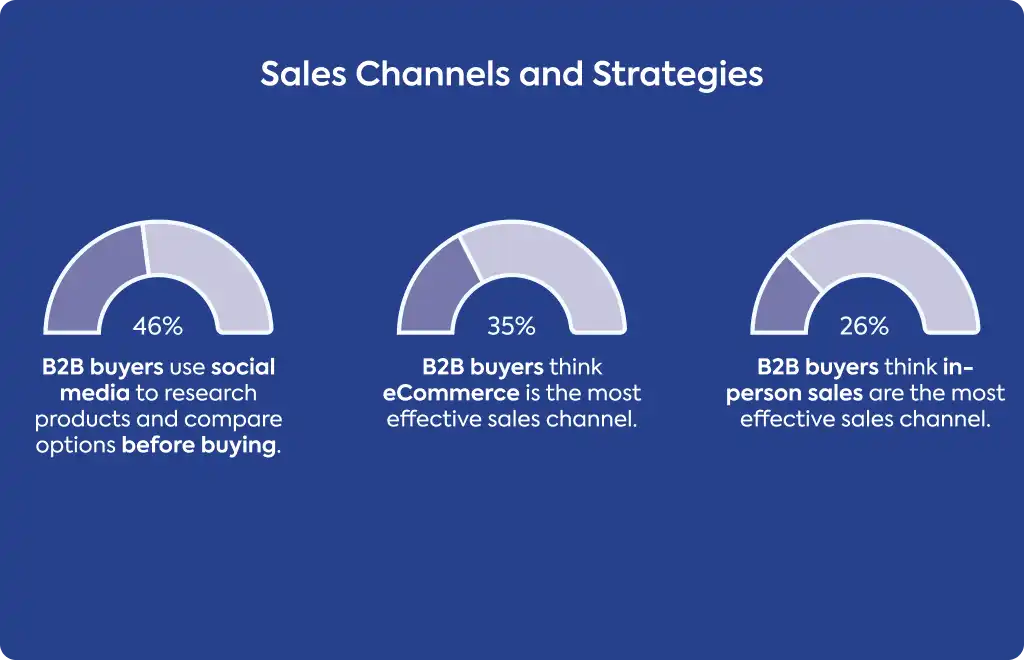

46% of B2B clients utilize social media to research products and compare options before purchasing.

According to B2B buyers, eCommerce is the most effective sales channel (35%), followed by in-person sales (26%), video conferencing (12%), email (10%), and telephone (8%).

On average, B2B buyers use 10 sales channels when researching products or services, illustrating the complexity of the buyer journey.

By 2024, the typical B2B buyer will leverage 10 or more sales channels throughout their purchasing journey.

In 2024, B2B eCommerce buyers employ between 3 and 10 digital channels to research and purchase products from sellers.

Nearly half of companies in a survey credited their B2B eCommerce success to leveraging online marketplaces.

Platforms like Amazon Business and Alibaba.com were cited by almost half of surveyed companies as pivotal to their B2B eCommerce achievements.

One-third of B2B buyers and sellers start their product search directly on Amazon, reflecting its dominance in the market.

Half of sellers reported losing online sales because they couldn’t match Amazon’s competitive pricing.

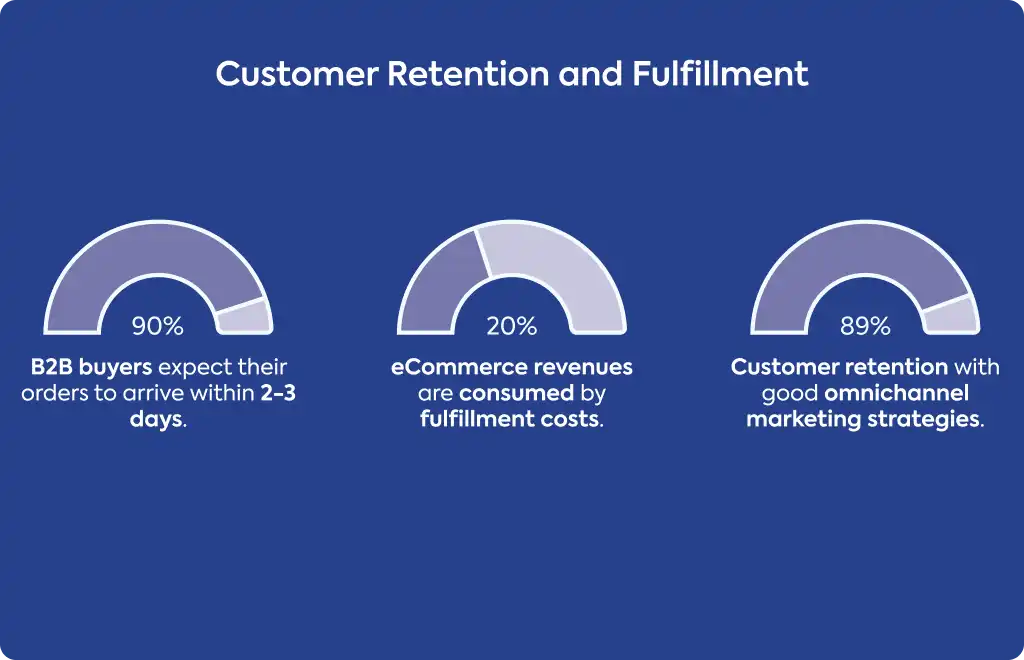

Companies with robust omnichannel strategies retain 89% of their existing customers, compared to only 33% retention for those without such approaches.

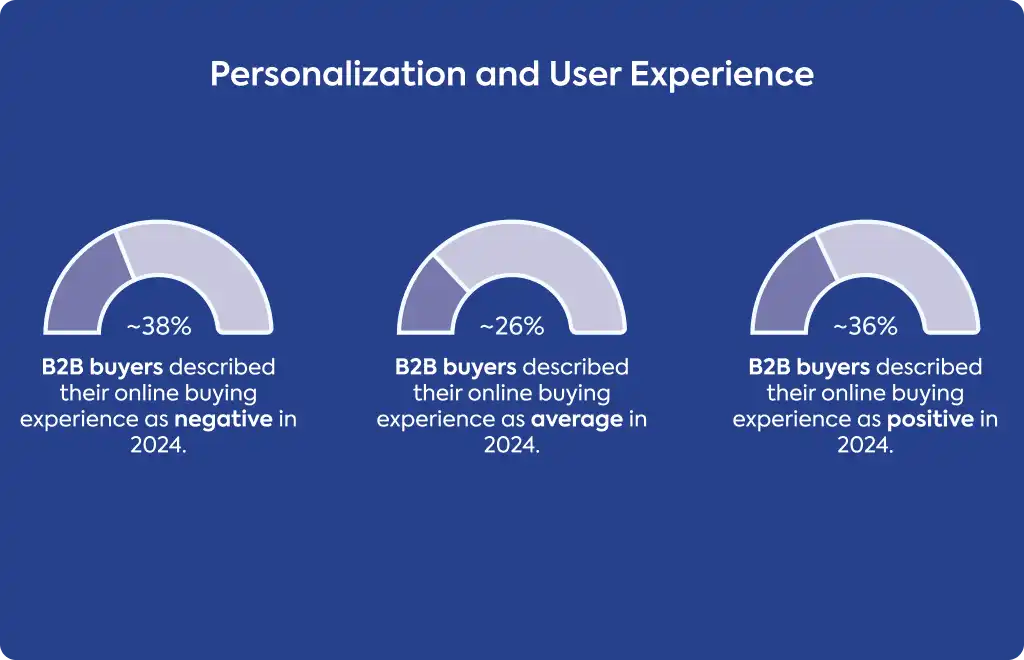

In 2024, 38.4% of B2B buyers described their online shopping experience as negative or somewhat negative.

25.8% of B2B buyers rated their 2024 online shopping experience as average, indicating room for improvement.

A total of 35.7% of B2B buyers reported a somewhat or very positive online shopping experience in 2024.

Personalization is key, with 66% of B2B buyers expecting fully or mostly tailored content when purchasing products or services.

An impressive 69% of B2B customers now anticipate a personalized shopping experience similar to Amazon's convenience and customization.

29% of B2B businesses are exploring the adoption of headless commerce solutions to enhance their digital capabilities.

Among companies with headless architecture, 77% report faster storefront updates, whereas 34% of businesses without it face delays of weeks or months in making changes.

77% of headless technology users successfully expand into new channels, compared to only 54% of non-headless businesses, demonstrating its competitive edge.

45% of B2B businesses have begun experimenting with generative AI technologies, marking a significant shift toward innovation.

Fully embracing the future, 32% of B2B businesses have completely integrated generative AI into their operations.

In 2023, one in four B2B organizations implemented AI in their eCommerce processes, while 56% are currently experimenting with its potential.

Only 25% of businesses are expected to realize ROI from generative AI technology by 2024, underscoring the challenges of early adoption.

The VR market is on track to grow from $12 billion to $22 billion by 2025, unlocking fresh opportunities for B2B eCommerce innovation.

By 2025, the North American B2B eCommerce market is forecasted to surpass $4,600 billion, reflecting significant growth.

In 2021, U.S. B2B eCommerce sales reached an impressive $1.7 trillion, underscoring its strong market presence.

In 2019, 80% of all B2B online business sales in the U.S. came from manufacturing and wholesaling, showcasing the dominance of these sectors.

The U.S. B2B eCommerce market is expanding steadily, with a compound annual growth rate of 10.7%, signaling continued progress.

Europe’s B2B eCommerce GMV is projected to exceed $1.8 trillion by 2025, highlighting the region’s robust digital market.

By 2024, 56% of B2B revenue in the UK is expected to be generated through digital channels, emphasizing the growing reliance on online platforms.

Valued at $141.4 billion in 2022, the UK’s B2B eCommerce market is anticipated to surpass $167.42 billion by 2025, showcasing rapid growth.

China’s online B2B market reached $1.2 billion in 2023, fueled by an 8.2% annual growth rate in cross-border eCommerce.

In 2024, 38.4% of B2B buyers reported having negative or somewhat negative online shopping experiences, highlighting persistent challenges in the sector.

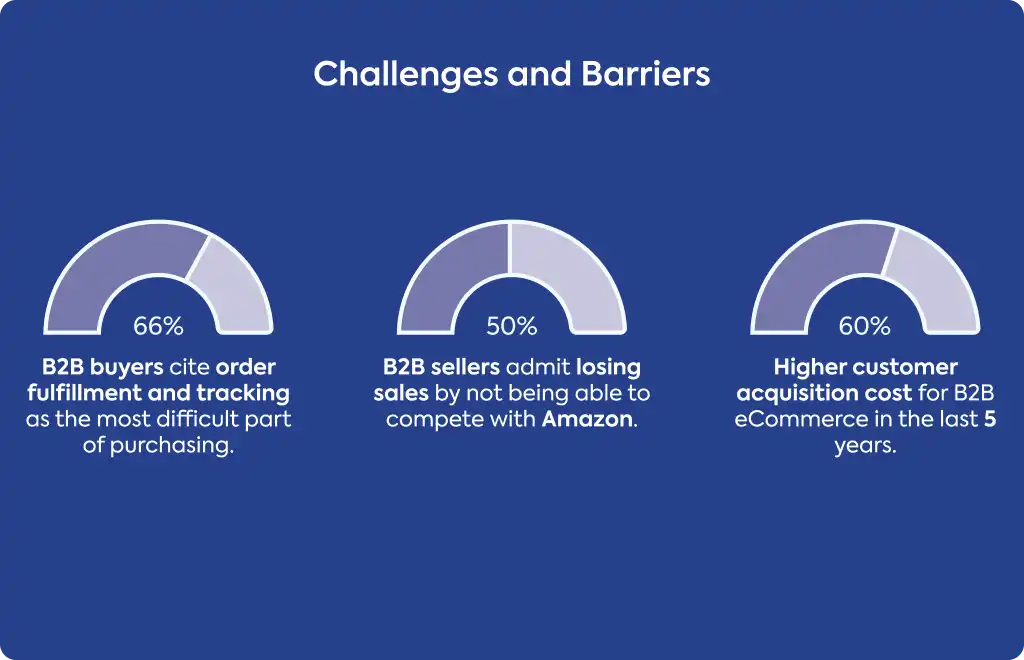

66% of B2B buyers cite order fulfillment and tracking as the most difficult part of the purchasing process, emphasizing the need for improved logistics.

A significant 74% of organizations believe that failing to adopt modern commerce solutions could negatively impact their business, underscoring the importance of innovation.

50% of sellers admitted losing online sales because they were unable to compete with Amazon’s pricing, showcasing the platform’s dominance.

Over the past five years, customer acquisition costs in B2B eCommerce have surged by 60%, increasing pressure on profitability.

For B2B companies, fulfillment costs now consume as much as 20% of eCommerce revenues, highlighting the financial burden of logistics.

In 2024, only about 25% of businesses are expected to achieve ROI from Generative AI technology, indicating slow adoption and implementation challenges.

The global social commerce market is anticipated to reach an extraordinary $8.5 trillion by 2030, signaling immense potential for businesses.

The use of mobile-focused sales channels, such as social media posts, mobile apps, and text messages, has seen a fourfold increase between 2019 and 2022.

By 2028, 68% of all eCommerce transactions in the U.S. are expected to come from mobile retail spending, highlighting the dominance of mobile commerce.

In the U.S., B2B eCommerce sales conducted via mobile devices are predicted to exceed $710 billion by 2025, emphasizing the growing reliance on mobile

Over the past three years, mobile B2B orders have surged by an impressive 250%, showcasing rapid adoption.

80% of B2B buyers rely on mobile devices during work hours for research and purchasing decisions, demonstrating their essential role in the buyer's journey.

In 2020, 87% of B2B purchases were linked to mobile apps, reflecting their pivotal role in facilitating transactions.

62% of consumers are less likely to buy from a brand if the mobile buying experience is unsatisfactory, highlighting the importance of seamless mobile usability.

75% of B2B buyers turn to social media platforms to inform their purchasing decisions, underscoring the influence of social commerce.

Among B2B buyers, 46% use social media to discover solutions, 40% to compare options, and 35% to collect essential information before making a purchase.

Nearly 46% of B2B clients actively use social media to gather product information or evaluate options, reflecting its role in the decision-making process.

More than 54% of B2B businesses have embraced social commerce by creating online stores, signaling a strategic shift to digital channels.

66% of B2B buyers identify order fulfillment and tracking as the most difficult part of the purchasing process, underlining a critical operational challenge.

90% of B2B customers expect their orders to arrive within 2-3 days, reflecting growing demand for fast delivery.

Globally, 41% of shoppers expect their online purchases within 24 hours, while 24% desire delivery in less than two hours, underscoring the need for speed in logistics.

For B2B companies, fulfillment costs can consume as much as 20% of eCommerce revenues, highlighting the expense of efficient delivery.

Companies with robust omnichannel marketing strategies achieve 89% customer retention, far outpacing the 33% retention rate for those without such strategies.

Statista, LinkedIn, Salesforce, Digital Commerce 360, McKinsey, Gartner, Google Cloud, Vantage Market Research, Digital Commerce 360, Grand View Research, Research and Markets, GlobeNewswire, and Think with Google.