Key takeaways

- AI transforms accounting through automated data processing, advanced financial analysis, fraud detection, and continuous auditing, shifting from transactional to strategic advisory work.

- Implementing AI delivers significant benefits: increased accuracy with fewer errors, dramatic time savings, data-driven decision making, reduced costs, enhanced client experiences, and better talent development.

- Successful AI adoption requires clear objectives, proper data preparation, appropriate technology selection, seamless integration with existing systems, and addressing challenges like security, cost management, organizational resistance, and regulatory compliance.

- The accounting industry is rapidly evolving with AI, projected to reach $16 billion by 2028, as firms transition from periodic reporting to real-time insights and continuous auditing.

The Basics of AI in Accounting

What Constitutes AI Technology in Financial Operations

AI in accounting transforms how financial professionals handle everyday tasks. This technology combines multiple approaches to solve complex problems. Machine learning algorithms analyze past financial data to spot patterns and predict future outcomes with impressive accuracy. Natural language processing helps extract valuable information from unstructured sources like contracts and emails without manual reading.

When you receive a stack of receipts or invoices, optical character recognition technology can transform printed text into digital format, making data entry much faster. AI tools process hundreds of invoices in minutes, freeing your accounting team from tedious manual entry while maintaining accuracy. Expert systems can make decisions based on accounting rules, while computer vision identifies and classifies images for further processing.

Machine learning algorithms are particularly valuable in accounting since they improve over time. The more financial data they process, the better they become at recognizing patterns and making accurate predictions. This self-improvement aspect gives artificial intelligence a distinct advantage over traditional static software.

Evolution of AI Applications in the Accounting Industry

The accounting industry has witnessed remarkable growth in AI adoption. The global artificial intelligence in accounting market is projected to reach approximately $16 billion by 2028, growing at an impressive 41-45% compound annual rate according to industry projections.

Modern accounting now extends beyond basic automation. What started as simple task automation has evolved into sophisticated applications for anomaly detection, forecasting, and predictive analytics. The Big 4 CPA firms—Deloitte, PwC, Ernst & Young, and KPMG—lead this transformation, applying AI to predictive analytics, auditing, tax compliance, and generating client insights.

The future of accounting clearly involves AI's impact on accounting workflows. Early AI applications focused on specific tasks, but today's systems work across entire accounting processes. AI is changing how accountants work, moving from periodic reporting to real-time financial insights and continuous auditing. Perhaps most interesting is how AI's analytical capabilities combine with blockchain's immutable record-keeping to create more transparent financial systems with better fraud prevention.

Key Applications of AI in Modern Accounting

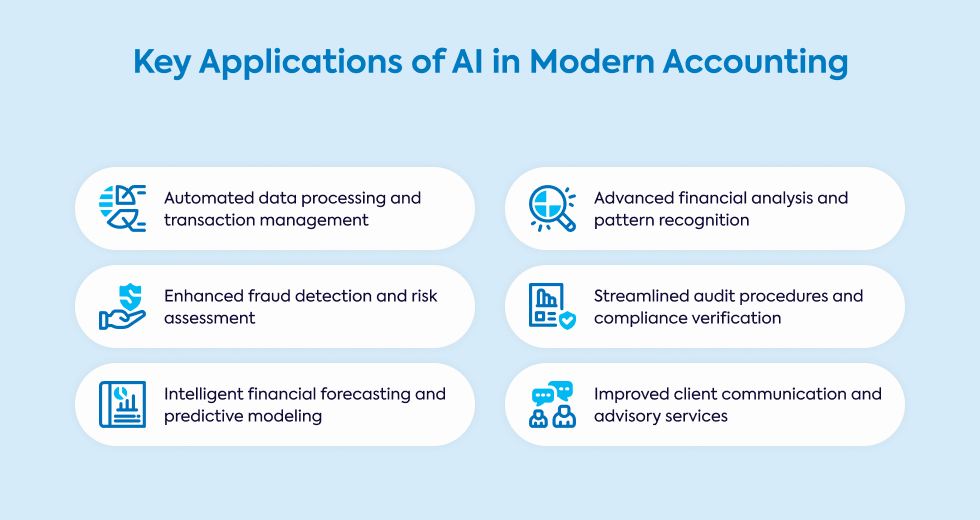

Automated Data Processing and Transaction Management

Accounting processes have been transformed through automation. AI-powered tools now handle complete invoice processing workflows, from supplier onboarding to payments. This streamlines operations significantly and reduces errors.

Data entry, once a time-consuming task, now happens through optical character recognition technology that extracts information from invoices and receipts. Cloud-based AI tools require data to be entered just once, significantly reducing human errors while enhancing workflow efficiency.

The repetitive accounting tasks of matching invoices with purchase orders now happens automatically. Paper document handling becomes unnecessary as everything happens digitally. AI even generates automated payment reconciliations in real-time and can notify suppliers about payment status through portals or email.

Robotic Process Automation creates software "bots" that mimic human actions for rule-based accounting tasks. These bots follow predefined workflows to process transactions without human intervention, only flagging exceptions that require human judgment.

Advanced Financial Analysis and Pattern Recognition

Financial data analysis reaches new levels with AI algorithms. These systems analyze financial statements and trends to spot anomalies and provide commentary on performance. The insights gained go deeper than traditional methods could ever achieve.

Business intelligence gets a significant boost when AI examines real-time data through dashboards. You'll find insights about cost-saving opportunities and risk management that might otherwise remain hidden. Machine learning identifies unusual patterns in financial transactions that might indicate problems or opportunities your team should investigate.

AI can analyze spend management patterns to highlight areas where your company might save money. This data-driven approach helps you make more informed decisions based on actual spending behavior rather than assumptions.

Manufacturing companies connect ERP systems with IoT sensors to analyze production data, giving them insights to improve operational efficiency and reduce costs. The combination of production and financial data creates a more complete picture for decision-makers.

Enhanced Fraud Detection and Risk Assessment

AI can detect irregularities and potential fraud by continuously monitoring financial transactions. The technology learns from the information it receives, becoming better at predicting patterns and spotting problems without sacrificing accuracy.

Risk of human oversight diminishes as AI systems check vast datasets for anomalies. Tools like MindBridge monitor transaction data in real-time, flagging discrepancies that might indicate fraudulent behavior. AI can help identify non-compliance issues quickly, such as purchases made outside company policy, alerting accounting teams to investigate further.

You can also leverage AI for proactive risk management. Its predictive capabilities identify potential risks before they become problems, allowing your team to address issues early. AI can create monitoring systems that scan blockchain records at high speed, adding another security layer to your financial operations.

Streamlined Audit Procedures and Compliance Verification

The auditing process has been revolutionized by AI accounting software. Large portions now happen automatically, with systems analyzing vast amounts of data in real-time. This allows auditors to focus on interpreting results rather than gathering them.

Leading firms like Deloitte and PwC have integrated AI-powered tools into their auditing workflows. These tools examine massive document volumes, flagging inconsistencies and speeding up the entire audit. AI platforms interpret complex tax codes, automating preparation and filing while ensuring compliance with current regulations.

Traditional accounting approaches relied on periodic audits, but AI enables continuous monitoring and verification of financial transactions. This shift helps identify discrepancies faster and improves overall accuracy. The technology is particularly useful for highlighting potential compliance issues or irregularities that require human attention.

Used in accounting firms worldwide, these systems help auditors quickly identify problem areas and cross-check compliance issues. This makes accounting functions like audits considerably faster and less resource-intensive than before.

Intelligent Financial Forecasting and Predictive Modeling

Using AI in accounting has significantly improved financial forecasting accuracy. AI software analyzes historical data and real-time trends to generate predictions that outperform traditional methods. These systems assess vast datasets to forecast revenue, expenses, and market behavior with remarkable precision.

Tools like Adaptive Insights and Oracle Financials help businesses generate more precise forecasts about cash flow and market performance. AI can assist with scenario generation for strategic planning, expanding the range of possible business opportunities you might consider.

The accounting and finance departments benefit from AI's ability to incorporate external market data and economic indicators alongside internal information. This comprehensive approach creates a more complete picture of potential futures. Some companies even use computer vision AI to gather external data points (like counting cars in retail parking lots) to enhance revenue forecasts for financial planning models.

Your accounting system gains powerful predictive capabilities when enhanced with AI, helping meet specific business needs more effectively. The technology doesn't replace human judgment but provides better information to support decision-making.

Improved Client Communication and Advisory Services

Accounting firms now offer more strategic value thanks to AI. The technology handles routine tasks, allowing accounting professionals to focus on higher-value services like financial consulting, tax planning, and strategic advisory. This shift transforms the accounting profession from transaction processing to trusted business advising.

AI-powered chatbots improve client service by providing instant responses to common questions 24/7, reducing the workload on your customer service team. Meanwhile, accounting professionals can analyze client data more thoroughly to deliver personalized insights and recommendations.

Applications of AI extend to client relationship management as well. Firms like KPMG use AI-driven CRM systems to offer proactive, data-backed advice, making their recommendations more strategic and personalized. AI-driven platforms produce precise financial management accounts while providing valuable insights clients can use for planning and risk management.

Modern accounting practices increasingly include AI-powered analytics to help accountants transition from number-crunchers to strategic advisors. This evolution allows accounting professionals to make meaningful contributions to their clients' financial success beyond compliance and reporting.

Significant Benefits of Implementing AI in Accounting

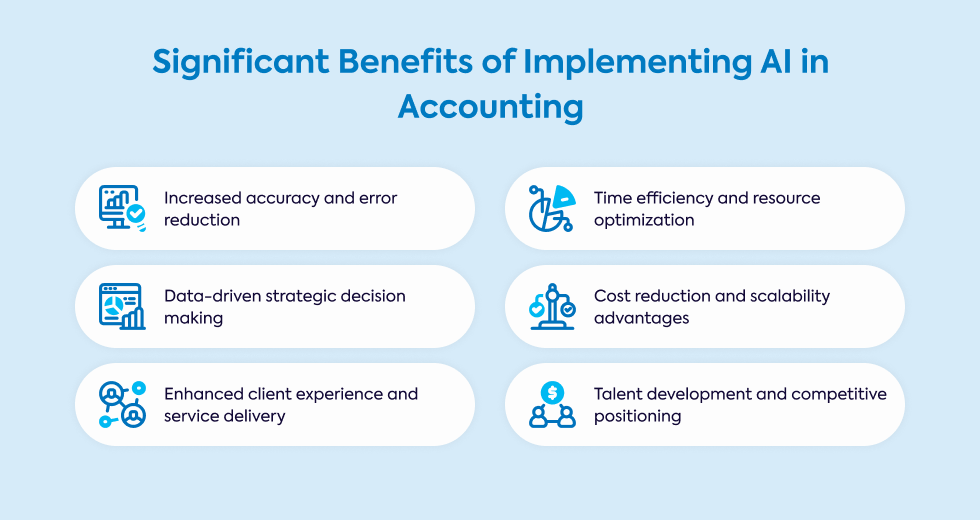

Increased Accuracy and Error Reduction

The benefits of AI in accounting include remarkable improvements in accuracy. AI systems process large data volumes in real-time, flagging inconsistencies for review and reducing human oversight risks. Unlike people, these systems don't suffer from fatigue or attention lapses, maintaining consistent accuracy across repetitive financial tasks.

Another benefit of AI in accounting comes from its continuous learning capabilities. The systems refine their algorithms based on new data, becoming more accurate over time. This reduces reliance on manual data entry, which is a primary source of errors in traditional accounting approaches.

Russell Frayne, Director of Transformation at Gravita, reported impressive results using AI solution products. Their tools ran 100 checks and spotted four accurate errors that would have taken an accountant over 30 minutes to find. This demonstrates how AI handles sensitive financial data with greater precision than manual methods.

The use of AI for accounting tasks extends beyond simple automation - it fundamentally changes how accuracy is maintained. These systems scan large datasets for inconsistencies without sacrificing precision, a task that would be prohibitively time-consuming for humans.

Time Efficiency and Resource Optimization

AI use cases in accounting primarily revolve around saving time and optimizing resources. The technology automates routine tasks, shortening the accounting cycle and eliminating bottlenecks caused by manual handling. This creates a more efficient operation overall.

Best AI implementations show impressive results. Rosie Cooper, Director of PM+M, noted that using generative AI tools like Silverfin Assistant for VAT compliance delivered significant time savings, with budgets halved on most tasks. The freed-up resources can then focus on activities that directly contribute to business growth and client service.

A 2023 McKinsey study confirms these benefits, showing high-performing AI organizations report 20% or greater bottom-line impact from AI usage. You can use AI-driven tools to streamline compliance tasks, ensuring they're completed both quickly and accurately.

AI can also be used to reduce the time auditors spend finding and assessing errors. The technology quickly identifies non-compliance issues and alerts the team, allowing faster resolution of potential problems. This efficiency gain translates directly to cost savings and improved service delivery.

Data-Driven Strategic Decision Making

Use cases of AI extend to strategic decision-making through actionable insights based on comprehensive data analysis. Machine learning in accounting enhances this process by providing forward-looking advice based on both historical and real-time data trends.

Applications of AI in accounting help firms transition from traditional roles to more consultative positions. This reduces reliance on intuition and potentially biased interpretations in favor of data-backed recommendations. You can set up automated alerts when clients hit key benchmarks, risk factors, or compliance events, enabling timely intervention.

The right AI tools improve financial decision quality by identifying trends, threats, and opportunities that might not appear through manual analysis. AI integration brings together different data sources to create a more complete picture of financial health and future prospects.

AI can be used to assess a client's financial history, market conditions, and economic forecasts, offering tailored investment strategies or tax planning advice. This capability is increasingly valuable as clients expect more strategic insights from their financial advisors. AI development services can help create custom solutions tailored to specific decision-making needs.

Cost Reduction and Scalability Advantages

The AI system benefits extend to significant cost reductions and scalability. Implementation of AI minimizes the need for manual labor as data volumes increase, creating direct operational savings. These systems maintain consistent accuracy as your business grows without proportional staffing cost increases.

AI applications automate compliance checks and fraud detection, reducing financial penalty risks from regulatory violations. Implementing AI in accounting can minimize errors, reducing costs associated with rework and corrections in financial reporting.

Organizations report substantial savings from reduced headcount needs for routine processing tasks while maintaining or improving output quality. This makes implementation of AI in accounting particularly attractive for growing businesses.

Existing accounting systems enhanced with AI can handle increasing transaction volumes without adding personnel, making it valuable during growth periods. The technology scales naturally with your business, processing more accounting data without proportional cost increases.

Enhanced Client Experience and Service Delivery

Accounting AI improves client experience in multiple ways. Clients receive quicker turnaround times, fewer mistakes, greater value, and personalized financial advice through AI-enabled services. This enhancement strengthens relationships and builds loyalty.

Using AI, accountants deliver insights into cost-saving opportunities, financial planning, and risk management directly to clients. Faster information processing allows more responsive service for client inquiries and needs. AI in the accounting department ensures consistent, reliable financial data that builds client trust in reports and recommendations.

Use cases of AI in accounting demonstrate how firms earn client trust, nurture relationships, and create competitive advantages compared to companies not using these technologies. AI's impact on accounting service delivery creates a clear differentiation in the market.

Discover how AI transforms client relationships by enabling more proactive service models. Instead of reacting to client requests, AI helps identify opportunities and potential issues before clients even ask. AI is set to become a standard expectation among sophisticated clients who want forward-looking financial partnerships.

Talent Development and Competitive Positioning

Integrating AI into accounting workflows makes firms more appealing to prospective employees who want to work for forward-thinking companies. AI implementation allows accountants to develop modern skills and keep pace with evolving client expectations.

Routine tasks become automated, shifting staff focus to more interesting, strategic work. AI adoption creates opportunities for team members to learn new skills and work with cutting-edge technology. Implementation of AI in accounting also improves junior team member training, offering continuous guidance on identifying and resolving common accounting issues.

The technology creates interactive onboarding experiences while reducing senior staff time spent checking work. According to the World Economic Forum, digital transformation specialists and business development professionals experience job growth in organizations that make decisions based on AI implementation.

This shift from manual data entry to higher-level strategic and analytical work increases job satisfaction and retention. Your team members stay engaged with meaningful work while the AI handles repetitive tasks.

Strategic Implementation of AI in Accounting Systems

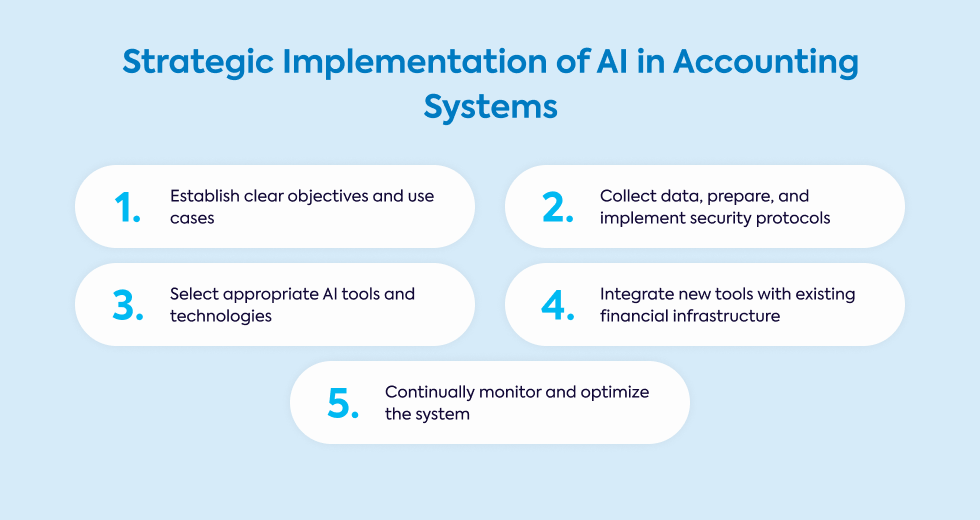

Establishing Clear Objectives and Use Cases

Before implementing AI, define specific goals that will drive adoption in your accounting department. AI use should align with business objectives to provide measurable outcomes. AI use cases might include automating data entry, improving audit accuracy, or enhancing fraud detection.

Focus on areas where AI creates the most value for your organization. Benefits in terms of efficiency should justify the investment. Financial reporting accuracy often represents an excellent starting point. Experts in AI development can help identify custom application of AI solutions addressing your specific challenges.

Data Collection, Preparation, and Security Protocols

Successful integration of AI and blockchain requires thorough data preparation. Gather financial transactions and records to train AI systems effectively. Accounting standard compliance remains essential throughout this process. Your accounting data must maintain integrity while becoming accessible to AI systems.

Sensitive data protection is paramount. Use robust security measures including encryption and regular audits. Ensure compliance with regulations like GDPR when deploying AI solutions. Address information gaps before proceeding with AI model training to improve system performance.

Selecting Appropriate AI Tools and Technologies

Choose the right accounting software with AI capabilities. Modern AI tools often come embedded in existing platforms. Consider cloud-based add-on software products that integrate with your existing ERP system.

Evaluate AI software options for specific functions: automated invoice processing, anomaly detection, forecasting, and tax compliance. The best AI solutions address your particular business challenges while integrating smoothly with existing workflows.

Assess which AI technologies best address your identified use cases. Look for AI solutions with demonstrated compliance with accounting standards like IFRS and GAAP to ensure reliability.

Integration with Existing Financial Infrastructure

Your AI system must work harmoniously with existing accounting software and financial tools. Business intelligence platforms should connect seamlessly to maximize value. Integrate your existing accounting system with new AI components to improve efficiency by eliminating manual data transfers.

Test integration points thoroughly to ensure information moves correctly between systems. Implement AI gradually, starting with specific processes before expanding. This approach allows your team to adjust while maintaining business continuity.

Continuous Monitoring and System Optimization

Workplace automation requires ongoing attention. Regularly review AI performance against key metrics like accuracy and efficiency. Continuous monitoring helps identify improvement areas while ensuring the system delivers expected benefits.

Update AI models based on new data and emerging business needs. Routine tasks automation should improve over time as the system learns from experience. Application monitoring helps identify and address issues before they impact operations.

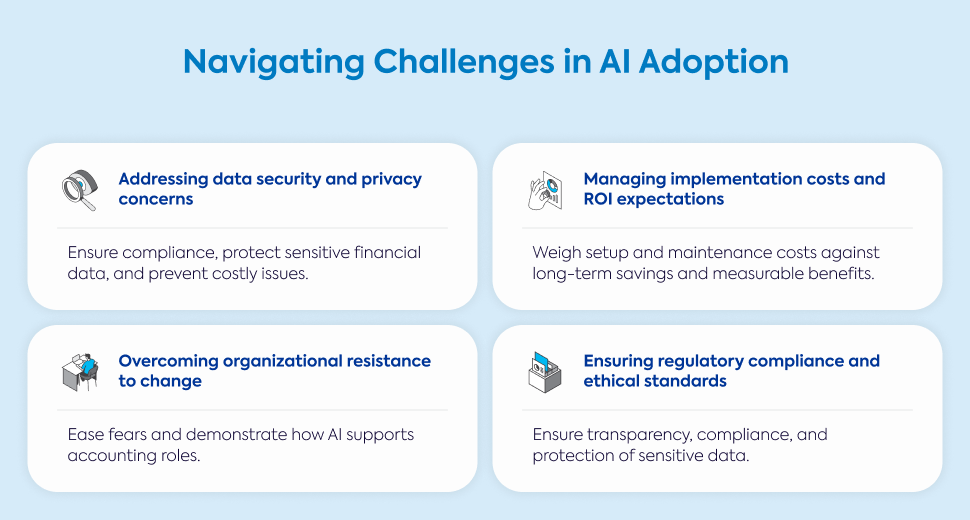

Navigating Challenges in AI Adoption

Addressing Data Security and Privacy Concerns

Data governance becomes crucial when implementing AI accounting systems. These solutions must comply with regulations to avoid breaches, fines, and lost client trust. Data security concerns extend to access controls as well. Restrict system access to authorized personnel to minimize internal breach risks.

Financial data protection includes encrypting sensitive information when training AI models. Integration security measures should cover all connection points between systems. Organizations that focus on security from the beginning avoid costly problems later.

Managing Implementation Costs and ROI Expectations

Cost analysis represents a critical step before investing in AI. Implementation costs include initial setup, training, testing, and integration - a substantial commitment. Development investment decisions should consider both immediate automation savings and long-term benefits.

Applications cost considerations should include ongoing maintenance. Adoption expenses extend beyond software to include training and process changes. Demonstrating benefits with concrete metrics helps secure leadership support and justifies the initial expenditure.

Overcoming Organizational Resistance to Change

Change management represents a significant challenge when adopting AI. Many accountants may feel threatened by technology taking over their roles. Professional development opportunities help address these concerns by showing how AI enhances capabilities rather than replaces people.

Staff education programs should teach employees how to work alongside AI systems. Using new technologies requires adjustment time and patience. Use case explanations help staff understand concrete benefits. Change communication should be clear, consistent, and empathetic.

Ensuring Regulatory Compliance and Ethical Standards

Regulatory requirements for accounting don't disappear with AI adoption—they become even more important. Ethical AI development includes addressing concerns around decision-making clarity and algorithm interpretability. Decision transparency helps stakeholders understand how the system reaches conclusions.

Financial compliance extends to keeping AI systems updated with changing accounting laws. Standards adherence ensures AI systems protect sensitive client information while meeting ethical requirements. Implement systems that make AI decisions explainable and traceable in an industry where transparency is fundamental.

Thinking About Implementing AI into Your Accounting Business? We Can Help!

Implementing AI in accounting can seem complex - from selecting the right tools to ensuring seamless integration with existing systems while maintaining data security and regulatory compliance. At Gauss, we specialize in developing custom AI solutions tailored to your accounting firm's specific needs and challenges.

Don't let technical hurdles prevent you from achieving the efficiency gains, cost reductions, and strategic advantages that AI offers. Our team of experts will guide you through each implementation step, from defining clear objectives to optimizing your system for maximum ROI.

Contact Gauss today to start a conversation about how we can help you harness the power of AI to transform your accounting practice from transaction processing to strategic advising.